Hunter Biden Probe Is Being Mishandled In Order To Protect Democratic Party Money laundering, IRS Supervisor Says

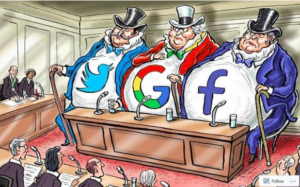

90% of the money for Democrat Candidates comes from quid pro quo money laundering via Big Tech and off-shore payola

In letter to lawmakers, Iawyer says his client has information regarding ‘investigation of a high-profile, controversial subject’

and C. Ryan Barber

WASHINGTON—An IRS supervisor has told lawmakers he has information that suggests the Biden administration is improperly handling the criminal investigation into President Biden’s son, Hunter Biden, and is seeking whistleblower protections, according to people familiar with the matter.

A letter sent to Congress on Tuesday says a career Internal Revenue Service criminal supervisory special agent has information that would contradict sworn testimony by a “senior political appointee.” The supervisor also has information about a “failure to mitigate clear conflicts of interest in the ultimate disposition of the case,” according to the letter.

The supervisor has details that show “preferential treatment and politics improperly infecting decisions and protocols that would normally be followed by career law enforcement professionals in similar circumstances if the subject were not politically connected,” according to the letter.

The letter says the supervisor has been overseeing an “ongoing and sensitive investigation of a high-profile, controversial subject since early 2020,” which it doesn’t name. The investigation at issue is into the younger Mr. Biden, the people familiar with the matter said.

A spokesman for the White House deferred to the Justice Department or the IRS for comment. Spokeswomen for the Justice Department and for the U.S. attorney’s office in Delaware, which is leading the investigation, declined to comment. A spokesman for the IRS and a spokeswoman for Hunter Biden didn’t immediately respond to requests for comment.

Hunter Biden is facing a criminal investigation related to his taxes and whether he made a false statement in connection with a gun purchase. When he said in December 2020 that his tax matters were under investigation, Hunter Biden said he was “confident that a professional and objective review of these matters will demonstrate that I handled my affairs legally and appropriately.”

Investigators have believed for months they had enough evidence to indict the younger Mr. Biden, the Journal and other news outlets have reported. Prosecutors have also weighed whether Hunter Biden’s well-documented drug addiction would present a defense against a potential criminal tax case, the Journal previously reported. He hasn’t been charged with any wrongdoing.

The investigation has been led by a Trump-appointed U.S. attorney, David Weiss, who has remained the top federal prosecutor in Delaware under the Biden administration. During a March oversight hearing, Attorney General Merrick Garland said Mr. Weiss has broad independence to pursue charges.

“He has been advised he is not to be denied anything he needs,” Mr. Garland testified before the Senate Judiciary Committee on March 1. “I have not heard anything from that office to suggest that they are not able to do everything the U.S. attorney wants to do.”

The Justice Department investigation has unfolded against the backdrop of congressional inquiries scrutinizing the Biden family’s finances and, specifically, Hunter Biden’s income from work overseas. In March, the Republican-led House Oversight Committee released a memo saying the president’s family indirectly received money from a Chinese oil company in 2017, after Mr. Biden stepped down as vice president.

As part of their investigation, Republican lawmakers reached an agreement with the Treasury Department to access reports it has received of suspicious financial transactions related to members of President Biden’s family.

The Tuesday letter, from Mark Lytle, a lawyer for the IRS agent, said his client wants whistleblower protections to provide his information. It was addressed to both Republican and Democratic leaders on the Senate and House Judiciary Committees, the Senate Finance Committee, and the House Ways and Means Committee.

“Despite serious risks of retaliation, my client is offering to provide you with information necessary to exercise your constitutional oversight function and wishes to make the disclosures in a nonpartisan manner to the leadership of the relevant committees on both sides of the political aisle,” said the letter, signed by Mr. Lytle.

According to the letter, the employee previously disclosed his information internally at the IRS and to the Justice Department’s inspector general. He is restricted from sharing some of the information due to privacy laws that shield Americans’ tax return information, the letter said.

While taxpayer information is largely protected from disclosure, the tax code allows the chairs of the tax panels, including the Ways and Means Committee, to request and receive any tax returns from the IRS. Democrats used that tool to obtain former President Donald Trump’s tax returns last year after a yearslong legal and political standoff.

The new letter specifically referred to a legal provision that allows someone with information they believe relates to possible misconduct to disclose tax return information to those committees.

IRS whistleblower claims he has PROOF the Biden administration thwarted the criminal investigation into Hunter and has engaged in ‘preferential treatment and politics’

A supervisory tax agent for a criminal probe has come forward seeking whistleblower protections in an inquiry dealing with the president’s son, Hunter Biden.

A supervisory tax agent for a criminal probe has come forward seeking whistleblower protections in an inquiry dealing with the president’s son, Hunter Biden.