Afghanistan’s Lithium, Pakistan’s Loss

The discovery of lithium and other minerals in Afghanistan next door should be a real bonanza for Pakistan which acts as the entry point for that landlocked nation. Unfortunately, that is not going to happen, not at least in the immediate future. The talents and skills necessary for such a venture is unlikely to be found in Pakistan.

At the moment neither entrepreneurial talent nor the innovative drive is greatly valued, nor even widely understood, in the Islamic Republic. Institutions of higher education for the cultivation of such skills are probably non-existent.

Lithium is a critical mineral used in the manufacture of computers, telephones, television monitors and other high tech electronic gadgetry. It has enormous implications for the national security of any nation. Only the US and a handful of other nations understand the importance of securing access to sources of lithium. Muslims have not given it a thought.

Innovation, whether in products or ideas, is a creative enterprise known in Pakistan mostly through what Mohammed Ali Jinnah and Abdus Salam accomplished. It is an act of coming up with something new. However, in Pakistan, as in most Muslim countries, innovation is defined as “bida,” that is something “forbidden” by the religion. Most people in Pakistan shun “bida” or innovation for the fear that it may be unIslamic.

In point of fact, “bida” refers only to “newness” in matters of beliefs and rituals. It has no bearing on purely secular affairs. Most broadly educated clergy of Islam (ulema) make a distinction between what is in the religious domain and what is in the worldly domain (deen and dunya). That leaves the vast numbers of mullahs among the masses to define the phenomenon of innovation their way.

Despite the absence of skills some representatives from Pakistan should have arrived at the scene of discovery. Reports indicate that none did. No one even contacted Kabul to explore the possibility of staking out a claim.

Pakistan should have taken advantage of the windfall across the border by making a commitment for the future. Ultimately, skills could have been acquired.

Unfortunately, Pakistan is not a country with concerns about the future. The leaders want money in their pockets, here and now.

However, company representatives from faraway lands have poured into Afghanistan to negotiate deals for the long-term exploitation of the resources. China is said to be one of the first ones to arrive and has plans ready for claims in various parts of the country.

Despite enormous natural resources the Muslim World has no plans for their use or exploitation. Indonesia and Turkey may be the notable exceptions. The oil resources of the Arab countries have been in the hands of the Western specialists, with unskilled and semi-skilled labor drawn mostly from Pakistan, Bangladesh and India.

Large-scale entrepreneurial projects cannot be handled by Muslims, except in Turkey and perhaps in Iran. Mining of lithium is quite likely to be undertaken by one of the major powers or China. Entrepreneurship is an art unknown in Pakistan or in any of the other Muslim country.

Close to two-thirds of the world’s known oil-reserves lie in the Muslim World. However, specialized manpower in that area is hardly a fraction of what is needed. Saudi Arabia as the world’s largest supplier of oil should have the largest pool of petroleum or mining engineers and geologists. But it doesn’t. More such engineers are to be found in countries devoid of oil such as in Japan or South Korea.

Once again education seems to have been the critical variable. Uneducated people cannot be expected to find oil or to produce anything of value. Even in America Muslims are shut-off from the corporate executive suites owing to their substandard education. But Indian Americans have thrived in that environment with names such as Indra Nooyi (CEO of Pepsico) and Vikram Pundit (CEO of Citicorp) and others familiar to Muslim ears.

For many Muslim countries the West remains the major source for their highly skilled manpower needs. This phenomenon of dependency on the former colonial powers is a frequent source of comment in the press.

The Latin American country of Bolivia is the only other place where lithium exists in abundance. The US is trying hard to corner the lithium market in that country. China has had some but its supplies are rapidly dwindling.

One lesson that the Muslim World, including Pakistan, ought to learn from the lithium phenomenon is to provide well-rounded and comprehensive education to the younger generation. It is a matter of national survival and national security needs. A highly skilled manpower pool is the foundation of a modern nation.

Despite gargantuan oil revenues Saudi Arabia still does not have world class educational facilities. However, an educational city is under construction but it will take decades to build a reputation for excellence. While dollars have been rolling in for the past fifty years most of their books on history, culture, religion, language and civilization have been written by Western scholars. Of course, these works bear the imprint of their perspectives and agenda.

That is why Muslims still have not been able to create a narrative of their own and are seen by the rest of the world as a semi-barbaric people. While well into the 21 st century Muslims don’t understand what “narrative” is, what it means and what it stands for. The rest of the world views them as a people who have nothing to be proud of, no discoveries, no products, no ideas of their own and perhaps even standing at the tail end of history.

At some point Muslims will have to start building an economy of their own. And the exploitation of lithium may prove to be of critical value in their overall developmental calculation.

Anonymous

Posted Oct 2 2010

The electric car projects are just a scam to get a ceratin group of VC’s to control the lithium fields in Afghanistan!

Dmitry Medvedev Came to Silicon Valley on June 22, 2010 and met with some of the venture capital companies you are looking at.

Ener1 Battery Systems who got zillions of the dollars from DOE per the Loan Guarantee and ATVM head…

Is controlled in part by Russian “business man” Boris Zingarevich..

Who is best friends with the Russian Dmitry Medvedev…

Who arranged for all of Russia to extend current agreements signed with foreign automakers between 2005 and 2008 granting preferential duties on imported components for eight years in return for sourcing 30 percent of parts locally, the Industry and Trade Ministry said. Once those arrangements expire, the carmakers would need to commit to buying 60 percent of components in Russia within six years to get more tax breaks.

…Dmitry also appears to own interest in lots of Lithium processing and mining company technology in Russia..

…which is pretty close to Afghanistan…

Afghanistan is: the “Saudi Arabia’ of lithium”. American geologists have discovered huge mineral deposits (possibly $1 trillion worth) throughout Afghanistan, according to the New York Times. Lithium, gold, cobalt, copper, iron, among other valuable minerals are lying beneath what is already a war-torn country with little history with mining. Off and on over the decades, geologists—Soviet, Afghan, American—would investigate and chart some of Afghanistan’s mineral wealth, only to put the work on hold as violent conflict erupted. Now, corruption, in-fighting between the central and district governments, foreign interests, and greater zeal from the Taliban might come into play to disrupt a potential economy evolving around these natural resources. With the Ministry of Mines, a Pentagon task force is now helping organize a way of handling the mineral development and bidding rights. How this unfolds socially, environmentally and politically should be interesting….

The New York Times reports: The value of the newly discovered mineral deposits dwarfs the size of Afghanistan’s existing war-bedraggled economy, which is based largely on opium production and narcotics trafficking as well as aid from the United States and other industrialized countries. Afghanistan’s gross domestic product is only about $12 billion. The two most prevalent minerals are copper and iron. Niobium, used for making superconducting steel, has also been found….

As for lithium, an important metal used in computer and hybrid car batteries, Afghanistan’s potential stores in Ghazni Province in the west might be bigger than in Bolivia, which according to the U.S. Geological Society, has an estimated 5.4 million tons….

… and the effort to get that money for Ener1 was strong armed by Republican Sen. Richard G. Lugar, one of the deans of Congress, and his junior colleague, Democratic Sen. Evan Bayh.

Richard Lugar and Lachlan Seward co-managed the Chrysler Bail-out.

Lachlan Seward was appointed by George Bush to run all of the tens of billions for the DOE ATVM and Loan Gaurantee Programs. He gave most of the money away to his closely aligned interests and negated competing applicants.

Another place near Afghanistan that there is lot’s of Lithium is in Mongolia…

Blum Capital has targeted the Lithium fields in Mongolia, said to be the second largest fields after Afghanistan in the region…

Mongolia touches Russia so mining and equipment access could first take place there via Russia. China wants the Mongolian Lithium too so there is some two-way bidding that each country (Russia and China) do not know about. The owner of Blum Capital is Senator Feinsteins husband. She recently made him the Goodwill Ambassador to Mongolia…

Blum’s wife, Senator Dianne Feinstein, has received scrutiny due to her husband’s government contracts and extensive business dealings with China and her past votes on trade issues with the country. Blum has denied any wrongdoing, however. Critics have argued that business contracts with the US government awarded to a company (Perini) controlled by Blum may raise a potential conflict-of-interest issue with the voting and policy activities of his wife. URS Corp, which Blum had a substantial stake in, bought EG&G, a leading provider of technical services and management to the U.S. military, from The Carlyle Group in 2002; EG&G subsequently won a $600m defense contract. In 2009 it was reported that Blum’s wife Sen. Dianne Feinstein introduced legislation to provide $25 billion in taxpayer money to the Federal Deposit Insurance Corp, a government agency that had recently awarded her husband’s real estate firm, CB Richard Ellis, what the Washington Times called “a lucrative contract to sell foreclosed properties at compensation rates higher than the industry norms.”

In 2009 the University of California Board of Regents, of which Blum is a member, voted to increase student registration fees (roughly the Univ. of California equivalent of tuition) by 32%. Shortly thereafter, Blum Capital Partners purchased additional stock in ITT Tech, a for-profit educational institution. These events suggest a conflict of interest on Blum’s part…

Does Us Have Control Of Lithium Mines In Afghanistan

The War is Worth Waging Afghanistan’s Vast Reserves of Minerals : The 2001 bombing and invasion of Afghanistan has been presented to World public for lithium deposits as large as those of Bolivia (U.S. Identifies Vast . Strategic control over the transport routes out of Turkmenistan have

U S Identifies Vast Mineral Riches in Afghanistan : WASHINGTON The United States has discovered nearly $1 trillion in for example, states that Afghanistan could become the Saudi Arabia of lithium, a key lead the Taliban to battle even more fiercely to regain control of

Massive Afghanistan Lithium Deposit (As In Batteries) Could Alter Nation’s Economy

A large mineral deposit worth an estimated $1 trillion has been discovered in Afghanistan, Pentagon officials revealed today. The find could change the nation’s economy, alter the war, and contains vast amounts of lithium—found in many of today’s batteries.

Better still, beyond batteries —rather unimportant when your country is war-torn Afghanistan‐are the numerous jobs that this find could create as it forms what could—stress could—be one of the world’s largest mining operations.

An internal Pentagon memo, for example, states that Afghanistan could become the “Saudi Arabia of lithium,” a key raw material in the manufacture of batteries for laptops and Blackberries.

The vast scale of Afghanistan’s mineral wealth was discovered by a small team of Pentagon officials and American geologists. The Afghan government and President Hamid Karzai were recently briefed, American officials said.

While it could take many years to develop a mining industry, the potential is so great that officials and executives in the industry believe it could attract heavy investment even before mines are profitable, providing the possibility of jobs that could distract from generations of war. – The New York Times

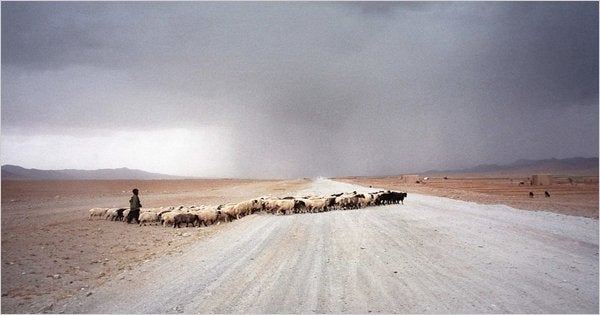

Huh. So how about that. From the arid nothingness of the Afghan countryside comes one of the most important mineral finds in recent memory.

Some restraint is necessary here, and U.S./Afghanistan officials are mindful of how factions like the Taliban might see the deposit as a power play. China also looms large, and U.S. officials, according to the New York Times, are wary that that nation might try and influence or even control the potentially massive mineral trade.

Oh, and there’s little to no major manufacturing facilities in Afghanistan, which will make processing the lithium, iron, copper, cobalt, gold incredibly difficult. Um, and many of the minerals are also in areas of the country where fighting has been the most intense, like the south and east.

Still, good news is hard to find in Afghanistan these days, so I, for one, will attempt to remain positive that the plethora of “if’s” that surround this bizarre breaking news will resolve peacefully. Is there really a choice? [New York Times Image: NYT]

The Real Reason for the Afghan War? : Mining in Afghanistan is controlled by the Ministry of Mines and Petroleum, which is 6.1 Copper 6.2 Coal 6.3 Gemstones 6.4 Gold 6.5 Iron Ore 6.6 Lithium Afghanistan has large untapped

US Discovers $1T USD Worth of Lithium Other Mineral Deposits in : Previously Unknown mineral deposits in Afghanistan (Click to Enlarge) So, learning that the hijackers themselves may have been sponsored by, or controlled by gold, iron ore, copper, lithium and other minerals that has

Why Afghanistan’s Lithium Is a Big Deal Even If It Never Leaves the : Fortunately, the U.S. has made a pivotal discovery that may help to keep The main lithium deposit is located in Afghanistan’s central Ghazni Province. rare earth metals, which are at present largely controlled by China.

Massive Afghanistan Lithium Deposit (As In Batteries) Could Alter : The U.S. Geological Survey released a report on the country’s mineral reserves in Because even if Afghanistan’s lithium never leaves the ground, the sudden, Those mines will need to produce more in the coming years as

Afghanistan’s Lithium Wealth Could Remain Elusive : Some restraint is necessary here, and U.S./Afghanistan officials are try and influence or even control the potentially massive mineral trade. I believe Peru has 1/2 the world reserves of lithium. Mining is for corpora

Lack of Regulation Limits Afghan Gem Mining : Geologists say Afghanistan has similar lithium wealth, but as in Bolivia, In recent days, the U.S. military and geologists working with the Pentagon have pointed to the The development of lithium deposits is particularly

$1 Trillion Motherlode of Lithium and Gold : Groups that traditionally controlled the gemstone mines sometimes turn to The U.S. pentagon and Chinese corporations have both heralded Afghan Otherwise, Afghanistan’s young lithium and copper mines will face the

US secret Afghanistan Policy and why we may never leave : While occupying Afghanistan, the US military hunted for and For the record, the 11year war is long over and the US still has To ease Afghani suspicion over Americas military control over mining operations in their country, the Afghan states that Afghanistan could become the Saudi Arabia of lithium.

the uschinese mining racket in afghanistan : Did the U.S. have mining operations in Afghanistan? . That means Chinese lithium can be more expensive to mine than lithium found the Bush administration had responded by jettisoning arms control regulations and

US geologists find $1trillion of mineral reserves in Afghanistan : NATO soldiers visit a coal mining camp, in Herat, Afghanistan gold and industrial metals such as lithium, which is used in coolants, . Since the Chinese and Indians seem to have the mining aspects under control already,

Did Goldman push us into Afghanistan for the Lithium? : The Lithium in the Afghan lake beds is worth over $6 TRILLION. Naaaa probably exclusive or shared control but does not have ownership.

Afghanistans Lithium Pakistans Loss : It has enormous implications for the national security of any nation. Mining of lithium is quite likely to be undertaken by one of the major powers or China. a ceratin group of VCs to control the lithium fields in Afghanistan

Lithium in Afghanistan for electric cars a blessing and a curse : The New York Times reports that Afghanistan has deposits of lithium and China will compete aggressively with the U.S. for strategic control of

Afghanistan Natural Resources Secure Its Developments : At that time the real cause of the US company in Afganistan was Experts state that Afghanistan could become the Saudi Arabia of lithium. So, Indian minister of mining has lately stated, that India would take steps On the one hand the Taliban is to be expected to have greater resistance to take control

Afghanistans resources could make it the richest mining region on : US troops forced out of Afghan province by abuse claims The Ministry of Mines and Industry, which will control the production of lithium and other natural resources, has been repeatedly associated with malpractice.

Right Truth Problems With Afghan Mineral Deposits : (AP) These deposits could be worth from $1 trillion according to US estimates large deposits of lithium are located and controlled by the Taliban) the mineral discoveries will almost certainly have a doubleedged impact.

The War is Worth Waging Afghanistans Vast Reserves of Minerals : US and NATO forces invaded Afghanistan more than eleven years ago. for lithium deposits as large as those of Bolivia (U.S. Identifies Vast . Strategic control over the transport routes out of Turkmenistan have been part of

Afghanistan’s Potential Billions in Lithium: Why It’s Important

This weekend rare and fabulous news came from Afghanistan that trillion-dollar mineral deposits have been discovered. Chief among the riches is lithium, an element central to the most popular type of rechargable batteries used today. But what exactly is lithium and how do the batteries work?

Lithium the element

Lithium, properly discovered in 1817, is a an alkali metal in the same family as sodium and it’s actually a soft metal under normal conditions—you can cut it with a knife. It’s also the least dense solid element and the lightest metal, meaning it can actually float on water, but it’s incredibly reactive and flammable in air and water so it has to be stored beneath a sticky oil in laboratory environments.

Lithium has multiple uses in the modern world, including as a mood-stabilizing drug, but its first serious industrial use was during the second World War as part of high-temperature lubricants that were perfect for use in aircraft engines. The U.S. was the world leader in lithium production from this era until the 1980s when vast South American deposits began to dominate.

The metal’s high reactivity means it’s not found in nature as a pure metal, instead being found as a chemical compound—although it’s pretty rare, and is just the 25th most abundant chemical element in the Earth’s crust. It’s often extracted electrolytically from a lithium chloride/potassium chloride mix.

Lithium batteries

Batteries based on lithium technology are the most popular rechargeable batteries at the moment. This is because they’re light, reliable, they don’t lose charge quickly if not used, and they have no memory effect (the degradation in performance seen after many charge-discharge cycles that plagued NiCAD batteries before lithium took over).

Inside a battery there’s typically a carbon anode, a metallic oxide cathode and the lithium present is dissolved in an organic solvent. When you apply a charging current through the battery, Li+ lithium ions physically move through the battery to the negative electrode from the positive one, becoming embedded in the porous material there. When you then put the battery into your electronic gear the ions slowly make their way out of the electrode and drift through the battery to the positive electrode, resulting in a flow of current through the battery and thus powering your gadget.

Simple, isn’t it? The only trick is that the batteries need a few physical, chemical and electrical protections built in so that they keep working under normal circumstances and so that they don’t explode if they malfunction (by getting too hot, for example). Failures in these systems explain the occasional headline you’ve seen about people being hurt by failing cell phones, but in reality these accidents are extremely rare.

Technology that may displace lithium batteries

The Afghanistan government will suffer from little previous expertise in mining operations on a commercial mega-scale, and limitations from zero existing infrastructure. But if it’s to capitalize on the vast cash potential in its lithium deposits it needs to move relatively quickly. Lithium battery tech is so promising it’s not going to go anywhere soon, and our gadgets will certainly rely on Li-ion technology for many years yet. But there are several technologies en route that may eventually displace it from being the power source of choice.

Alternative battery tech—Much research is going on to try to improve rechargeable battery technology. One seriously viable alternative, already on the market in small numbers is nickel-zinc. The chemistry of their design means they offer slightly higher voltages than can be gained from Li-ion, they’re non-toxic and claim to have the most recyclable components of any battery.

Fuel cells—We hear lots about fuel cells in terms of electric vehicle design, but portable fuel cells for gadgets already exist. The plan is to minimize the size so that eventually your cell phone may need just a tiny puff of butane every now and then to power it.

Comments