THIS REPORT HAS BEEN PROVIDED TO THE FBI, FINCEN, FTC, FEC, SEC, OGE, DOJ, INTERPOL AND CONGRESSIONAL INVESTIGATORS (THE MASTER REPORT IS OVER 2000 PAGES). SEE WHY:

TOXIC COMPANIES (LINK)

AMERICA NEEDS YOUR INPUT ON THE HOUSING MASTER-PLAN

READ THE PLAN AND SUBMIT YOUR THOUGHTS, EDITS AND IDEAS:

(LINK) CALIFORNIA AND HUD CONSOLIDATED HOUSING SOLUTIONS MASTER-PLAN Rev 2022 5F

___________________________________________________________________

SILICON VALLEY’S TRILLION DOLLAR CULTURE OF BRIBERY; CENSORSHIP; SEX TRAFFICKING; ELECTION MANIPULATION; PAYOLA TO CITY, STATE, COUNTY AND FEDERAL OFFICIALS; LUDICROUS EXCESS AND REVOLVING DOOR PAY-OFFS TO GOVERNMENT INSIDERS HAS DESTROYED HOUSING OPPORTUNITIES FOR THE POOR AND MIDDLE CLASS BY NEGATING HUMAN RIGHTS OVER OLIGARCH LUXURIES!

The Silicon Valley solution to “The Housing Crisis” is all talk, window dressing, dog-and-pony, un-responded to white papers and absolutely no meaningful action.

FOR EXAMPLE, THIS PLAN SOUNDS NICE BUT ONLY A HANDFUL OF PEOPLE GOT ANY BENEFIT FROM IT WHEN MILLIONS OF PEOPLE NEEDED TO GET BENEFIT AND YOU GET SEE THE PROBLEM COMING FOR DECADES: AdminPlanFor San Mateo

REAL ESTATE DEVELOPERS, OLIGARCHS AND REAL ESTATE BANKS PAY BRIBES TO COUNTY OFFICIALS TO KEEP AFFORDABLE HOUSING FROM GETTING BUILT BECAUSE IT COMPETES WITH THEIR SCHEMES!

BIG BANKS, BIG BUILDING DEVELOPERS AND TECH BILLIONAIRES ARE BRIBING COUNTY OFFICIALS TO STOP THEM FROM DOING ANYTHING!

BATHROOMS IN CALIFORNIA COST AS MUCH AS A TWO BEDROOM HOUSE COSTS IN THE REST OF AMERICA!

CORRUPTION IS KILLING HOUSING: Corruption is rampant at HUD and affordable housing projects

COUNTIES PAD HOUSING SO NOBODY CAN AFFORD IT: GOVT HOUSING ENDS UP BEING TOO EXPENSIVE

LA FOUND THAT BUILDING THIS WAY SOLVES THE HOUSING CRISIS BUT BIG INSIDERS ARE PAYING POLITICIANS BRIBES TO KEEP THIS FROM HAPPENING: Los-Angeles-County-Off-Site HOUSING

THIS IS HOW BAD IT HAS GOTTEN: winston-v-cuyahoga-metropolitan-housing-authority

“This is decades and decades of failures from California politicians taking bribes from Developers and Real Estate Lobbies,” experts say

MODERN FORENSICS TRACES ALL OF THEIR SECRET BANK AND STOCK ACCOUNTS WHERE THE BRIBES GO!

Kayla Haskell, homeless outreach specialist with Pathways to Housing DC, from right, interviews David Putney, 64, who has been homeless for two years, near the McPherson Square Metro Station in Washington on Jan. 22.Katherine Frey / The Washington Post via Getty Images

LOS ANGELES — The only thing that kept LaRae Cantley going was her three children.

She grew up surrounded by poverty and addiction, but despite her difficulties, she never expected to be homeless.

Yet one day in the late 1990s, a sheriff’s deputy knocked on the door of her South Los Angeles house and told her and her husband they had five minutes to vacate the property. Cantley was stunned. She knew nothing about her husband’s finances and had no idea he skimped on rent.

With nowhere to go, she sent their three children to live with the children’s great-grandparents. She and her husband divorced, and she found herself homeless.

“There was nothing to catch us,” she said.

Cantley, 37, lived on the streets for 15 years. She was among thousands of Californians without a home, a problem that continues to grow. Last year, homelessness rose 16 percent to 151,000 people.

Many blame mental illness and drug addiction for the soaring numbers, but experts say that is only part of the puzzle. The state’s severe housing shortage that has forced rents to increase at twice the rate of the national average and put the median price of a single family home at $615,000, has also contributed to the crisis.

John Maceri, CEO of the Los Angeles-based social services provider The People Concern, said social safety nets, like affordable housing and job training, are all but gone, leaving already vulnerable people to fend for themselves.

“You reap what you sow,” Maceri said recently.

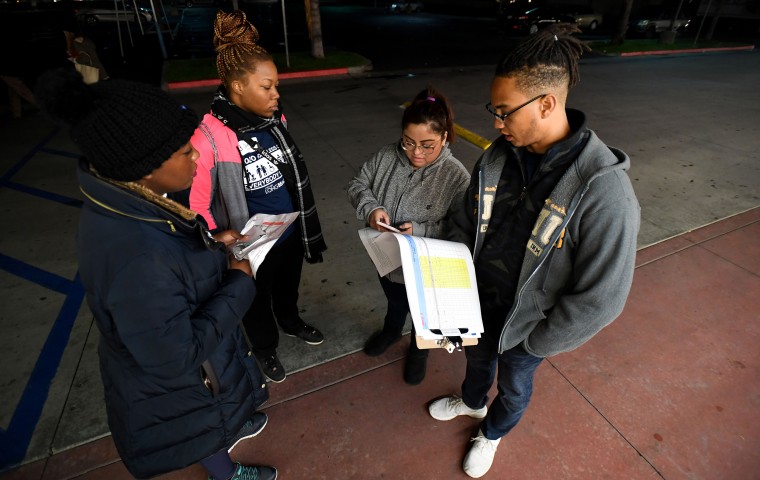

He was one of 300 volunteers who gathered in Santa Monica last week for an annual homeless count, part of a larger effort in Los Angeles County that spanned three days and covered thousands of square miles. Similar counts took place in San Francisco, San Diego and other parts of the country.

The federally mandated survey stretches to every nook and cul-de-sac. Its mission is simple: using U.S. census tracts, count every person who appears to be experiencing homelessness and report those numbers to the county. The county tallies them up using statistical analysis and sends them to the state, which sends a report to the U.S. Department of Housing and Urban Development.

Similar to the census, the federal government doles out resources based on these findings. Cities and counties with the most need typically get the most money.

In Santa Monica, an idyllic coastal oasis in Southern California, the count took on the air of a community fair. Parking attendants ushered hundreds people into St. Monica Catholic Church on a Wednesday night, offering warm drinks and snacks to volunteers who greeted one another. The crowd filled with local residents and city officials was thick with anticipation.

Around 11 p.m., hundreds of volunteers, lawmakers and law enforcement officers embarked on what has become routine for the affluent community. The city was an early adopter of the count, said former mayor and current state Assemblyman Richard Bloom.

The Democrat served three terms as Santa Monica’s mayor when homelessness still felt like a local problem. The city, with its soft beaches and year-round sunshine, had always been a magnet for homeless people. Residents and outsiders sang a familiar refrain: People experiencing homelessness were drawn to Santa Monica’s comfortable environment and abundant social services.

“Homelessness has been here for decades,” Bloom said. “But for many of those decades, we really didn’t see it as much as we do today.”

In 2005, when Los Angeles County conducted its first count, more than 82,000 people were reported as homeless, according to the Los Angeles County Homeless Services Authority. By 2019, that number had dropped to 59,000.

Experts say these fluctuations reflect the issue’s complexity and enormity.

“This is decades and decades of failures,” said Heidi Martson, interim executive director of the homeless services authority. “It’s going to take time.”

One of the biggest failures has been state and local leaders’ inability or unwillingness to address the high cost of housing. Nearly half of Los Angeles County residents pay 50 percent of their income on rent, according to the housing authority. Even building affordable housing in Los Angeles was estimated in2016 to cost $414,000 for a two-bedroom unit, according to a city of Los Angeles report “Comprehensive Homelessness Strategy.”

Los Angeles County finds housing for 130 people every day, yet 150 people fall into homelessness daily, according to the authority.

“This is truly poverty,” Martson said.

Two other factors repeatedly come up in discussions about homelessness in California: Gov. Ronald Reagan signing the Lanterman-Petris-Short Act in 1967, which ended the practice of admitting patients into psychiatric institutions against their will, and Gov. Jerry Brown reducing the prison population after a federal three-judge panel ordered the state in 2009 to cut the inmate population by 46,000 people.

Neither move came with social safety nets, such as job training and mental health treatment, to ensure these people would land on their feet, said Alise Orduña, Santa Monica’s senior adviser on homelessness.

“We needed to help people readjust to society,” she said.

Cantley said she first signed up for housing through the city in 1998, but didn’t receive it until 2012. After spending more than a decade on the street, she found herself at odds with the walls and routines thrust on her.

It took her three years of “damage control” to adjust, she said. She’s not alone. In recent years, a new trend has emerged among service providers to pair formerly homeless people with support services.

For Cantley, that meant counseling for domestic abuse and depression, she said. Now, she is an advocate and activist who works with others with similar experiences. But not all people enduring homelessness are able to access those types of resources.

Mike Sanders spent six years in prison for robbery before his release in 2015. During his time behind bars, his mother died and the rest of his family became financially unstable. With no money and no job, Sanders, 43, became homeless. He slept on skid row in downtown Los Angeles for awhile, but it was too dangerous, he said. Church steps and shelters felt safer.

Eventually, he signed up for housing through The People Concern and found a stable home three years later, he said. Now, he lives in a former hotel near 5th and Spring streets downtown, he said.

“I love it,” Sanders said of his home. “I don’t have to share my room, my bathroom, with no one.”

Still, Sanders does not work. His income filters in through panhandling and the state’s General Assistance program. He spends his days circling downtown in a wheelchair, getting food and cash where he can.

The Bay Area’s dynasties and Dianne Feinstein’s CBRE Realty go to great lengths to keep affordable housing out of California.

Some of them pay epic covert bribes range from small family businesses to juggernauts—and include everything from philanthropy to sex scandal, all from some of America’s wealthiest families.

Here’s a look at 5 headline-making bloodlines.

1. Sobrato Cartel, Founded: 1979 The Founder: John A. Sobrato (pictured) History: John A. Sobrato’s father, John Massimo Sobrato, owned a famous Italian restaurant in San Francisco. When he died, John’s mother Ann sold the restaurant for $75k and invested the proceeds in South Bay properties. John took over the business in the early 1960s before starting his own company, the Sobrato Organization, in 1979. Famous Members: John’s son, John M. Sobrato, is the CEO of the family business, while John remains chairman. Sue Sobrato, John’s wife of 50+ years, is a trustee, along with daughters Sheri and Lisa, and Lisa’s husband Matthew Sonsini. The Latest: Following in the footsteps of Ann Sobrato, the charitable family has donated more than $300M to local nonprofits since starting a family foundation in 1996. The Sobrato Family Foundation, set up by daughter Lisa, has provided 68 nonprofit organizations with more than 333k SF of operating space, at a value of roughly $5.5M. John and Sue, along with their son John M., have also signed giving pledges promising 100% of their wealth—an estimated $6B to date – to charity either during their lifetime or upon their death. Famous Properties: The Sobrato Organization owns 7.5M SF of office space in Silicon Valley, with tenants like Apple, Yahoo and Netflix. The firm also owns 6,600 apartments.

2. Shorenstein Cartel, Founded: 1960 The Founder: Walter Shorenstein History: Walter Shorenstein bought Shorenstein Co (then named Milton Meyer & Co) in 1960. He changed the name in 1989. Famous Members: Walter’s son Doug (pictured) ran the company until this past November, when he lost his battle with cancer. Walter’s daughter Carol Shorenstein Hays is a Tony Award-winning theater producer many times over. The Latest: Doug, known for his uncanny instincts regarding real estate, turned the company into a powerhouse, with the firm boasting over 70 properties in 13 cities, including LA, Portland, New York and San Francisco. Walter and his wife also started the Joan Shorenstein Center on Press, Politics and Public Policy at Harvard’s Kennedy School of Government in honor of their late daughter Joan, who was a journalist at the Washington Post and CBS News. Walter passed away in 2010 at the age of 95. Famous Properties: Under Doug’s leadership the company purchased such high-profile properties as Miami’s Wachovia Financial Center (formerly First Union Financial Center), and the Starrett-Lehigh Building in New York. Other iconic investments include Chicago’s John Hancock Tower and New York’s Park Avenue Tower. Fun Fact: Walter Shorenstein and a group of investors bought the San Francisco Giants in 1992 for $100M, and Walter acted as an adviser to Presidents Johnson and Carter.

3. Bechtel Cartel, Founded: 1898 The Founder: Warren A. Bechtel (pictured with his wife, Clara) History: Warren started Bechtel engineering and construction company when he was just 25 years old and nearly bankrupt, with a new baby on the way. Famous Members: When Warren died unexpectedly, he was succeeded by his son Stephen Bechtel Sr., who became chief executive of the Hoover Dam project. His son Stephen D. Bechtel Jr. took over in 1960 and ran the company until 1989, when he handed it over to his son Riley. The Latest: Riley stepped down as CEO in 2014, and today the company is run by his son Brendan, who is president and COO. That’s five generations. The company has 58,000 employees in nearly 50 countries. Famous Properties: The firm is known for such iconic projects as the Hoover Dam, the Channel Tunnel, Crossrail London and the Tacoma Narrows Bridge.

4. Berg Cartel, Founded: 1997 The Founder: Carl and Clyde Berg Famous Members: Brothers Clyde and Carl founded Berg & Berg Enterprises and developed campuses for some of Silicon Valley’s most prominent companies. A former partner of John Sobrato, Carl Berg acquired Mission West properties REIT in 1997 and sold it in 2012 to developer Divco West for $1.3B. But he’s not out of the real estate game. He still owns Microsoft’s Mountain View campus (pictured) and some buildings leased to Apple. In fact, Microsoft is planning an expansion for its campus. The Latest: Carl’s brother Clyde has had a challenging few years, battling in court with his estranged wife. The judge ultimately declared Berg “factually innocent” and dismissed the case as an “elaborate fraud.” Famous Properties: Microsoft campus, Apple, Silver Creek Business Park/Ciena Campus, and Orchard Trimble.

5. Wallace Cartel, Founded: 1928 The Founder: William S. Wallace and William Edwin “Ed” Wallace Famous Members: Father-son duo William and Ed Wallace opened Wallace Realtors in 1928. At the time William was a hospital manager and father of six, who had dabbled in real estate for most of his life, and Ed was a recent UC Berkeley grad with a background in the cleaning and dyeing industry. Ed’s son Clark joined the company business in 1958 after spending three years in the Navy. He runs the company today. Famous Properties: Notable deals include the sale of the 5,000 remaining acres of the 8,000-acre Moraga ranch to Utah Construction and Mining Co for $4M in 1953. He also sold the 108-acre Moraga Center to Bruzzone in 1964 and 2,300 more acres of Moraga to Bruzzone in 1967. Clark began developing projects on his own in 1974, including the Country Club and Sanders Ranch in Moraga, and the Pine Grove office complex and Orinda Theater project in Orinda.

Family dynasties own hit-man bloggers, crooked law firms and bribery outlets that they use to control politicians.

David Rockefeller’s bag man on the West Coast was James Bronkema, now dead. The Rockefellers have a large covert operation in California and spend billions buying politicians like Newsom, Feinstein and Pelosi!

Read more at: https://www.bisnow.com/san-francisco/news/commercial-real-estate/5-san-francisco-bay-area-real-estate-dynasties-56491?utm_source=CopyShare&utm_medium=Browser

Ethics Study: Silicon Valley Housing Crisis – Seven …

Report: Silicon Valley housing crisis linked to declining …

The Effects of Silicon Valley Companies on the Bay Area …

In California Section 8 Housing Choice Vouchers CAUSE You To Be Homeless – The Total Failure Of A Housing Program!

By Carla Lee

– Landlords won’t accept them because they are punished with extra rules if they do. There are no reasonable incentives for landlords to participate and every reason for them not to participate. HUD must increase the cash and tax incentives for landlords.

– The Section 8 program does not screen for meth and heroin use so the 10% of Section 8 people on drugs create a bad reputation that ruins it for the 90% that are not on drugs. HUD and the County must blood test for drugs.

– People with excellent credit scores, perfect landlord references, nice personalities, a lifetime of past work and the ability to fix their own rental units are lumped in with gang members and deviants. There should be a “Gold Star” rating for high-quality applicants.

– There is no centralized rent board to find all of the Section 8 offerings. The State must fund and build such a web based rent board, properly staff it and advertise it.

– California does not support pre-fab homes, glampers, RV’s or other modern housing systems because the Unions, builders and real estate agents lobby against them for competitive purposes.Public officials must be arrested for taking bribes from these anti-affordable housing groups.

– Google, Facebook, Netflix, Linkedin, Twitter, etc. and the Tech Mafia have lobbied to take over, bus into and ransack the local housing system because they have anti-trust violating monopolistic power, armies of lobbyists and they pay bribes to everyone.While minor rules have been applied to them for media optics, nothing has been required of them to offset the tens of thousands of housing losses they have caused. Google, Facebook, Netflix, Linkedin, Twitter, etc. and the Tech Mafia must be forced to pay double the amount allocated for a Section 8 voucher in California.

– In the crisis areas of California the Tech Mafia has forced the rents to be so high that the current Section 8 voucher amounts can’t pay for any of the rents. Section 8 Vouchers in Northern California and the LA basin must pay at least $2000.00 of the person’s rent or there is now no possibility for anyone to rent anything. The Tech Mafia must be required to pay at least half of the subsidy.

-There is zero transparency in the ‘Waiting List’ programs and the Lists are tainted with bribes to officials, sex-for-Section-8, Political bias, reprisal delays and other unfair process. List transparency and standardized metrics must be deployed.

– There is enough property available to build and house four times as many people as those who currently need Section 8 but counties won’t issue the permits to allow green, sustainable pre-fab builders to build those modern, safe, classy, pre-fab units because they would break the existing crony, payola, bribe kick-back schemes that Supervisors and Mayors get in many counties. The State must order the counties to issue the permits and begin immediate punitive lawsuits against the individuals and counties who do not issue those permits within the next 14 days.

– The raw criminality and bribery in HUD and County offices is staggering. The FBI must be ordered to conduct a deep investigation of California housing bribes, skims and stock market payola.

– Town Hall public meetings are no more than PR optics sessions that pretend to be offering solutions but never end with any hard plans being committed to by officials.

How Housing Policy Is Failing America

When a woman in McKinney, Texas, told Tatiana Rhodes and her friends to “go back to your Section 8 homes” at a public pool earlier this month, she inadvertently spoke volumes about the failure of a program that was designed to help America’s poor.

Created by Congress in 1974, the “Section 8” Housing Choice Voucher Program was supposed to help families move out of broken urban neighborhoods to places where they could live without the constant threat of violence and their kids could attend good schools.

But somewhere along the way, “Section 8” became a colloquialism for housing that is, to many, indistinguishable from the public-housing properties the program was designed to help families escape.

How did this happen? To begin with, Section 8 is poorly designed. It works like this: Families lucky enough to get off lengthy waiting lists are allowed to look for apartments up to a certain rent, which varies for each metro region. This figure is called the “fair market rent,” and is calculated by HUD every year for each metro area. The tenant pays about 30 percent of his income, and the voucher covers the rest of the rent (this is based on the idea that families should not spend more than one-third of their income on rent).

But the fair market rent cut-off point often consigns voucher-holders to impoverished neighborhoods. This is in part because of how that number is calculated: HUD draws the line at the 40th percentile of rents for “typical” units occupied by “recent movers” in an entire metropolitan area, which includes far-flung suburbs with long commutes and, as a result, makes the Fair Market Rent relatively low. In New York City, for example, the Fair Market Rent for a one-bedroom is $1,249, a price that would relegate voucher-holders to the neighborhood of Brownsville in Brooklyn, one of the most dangerous places in the city, and where the most public housing is located.

Technically, voucher holders can live anywhere in a region that meets the price restrictions. But the tendency is for people to stay in neighborhoods that are familiar to them, though a few areas have created robust mobility-counseling programs to try and mitigate this. Additionally, as Eva Rosen has detailed, landlords in low-income areas aggressively recruit voucher-holders, as the vouchers are a much more reliable source of rent than other low-income tenants have available.

The failings of Section 8 go far beyond flaws in how the program was designed to how the the states have implemented it. People can argue all they want about the merits of subsidized housing, but given that Section 8 exists, it would seem advantageous for states and municipalities to take advantage of federal funds to help families find better housing. But many states seem especially determined to keep voucher-holders in areas of concentrated poverty.

“The whole idea of Section 8 in the beginning was that it was going to allow people to get out of the ghetto,” said Mike Daniel, a lawyer for the Inclusive Communities Project, told me. (Daniel has sued HUD over the way it is carrying out the program in Dallas.) “But there’s tremendous political pressure on housing authorities and HUD to not let it become an instrument of desegregation.”

For example, in much of the country, landlords can refuse to take Section 8 vouchers, even if the voucher covers the rent. And, unlike the landlords in poor neighborhoods in Eva Rosen’s study, many landlords of buildings in nicer neighborhoods will do anything to keep voucher-holders out. The result is that Section 8 traps families in the poorest neighborhoods.

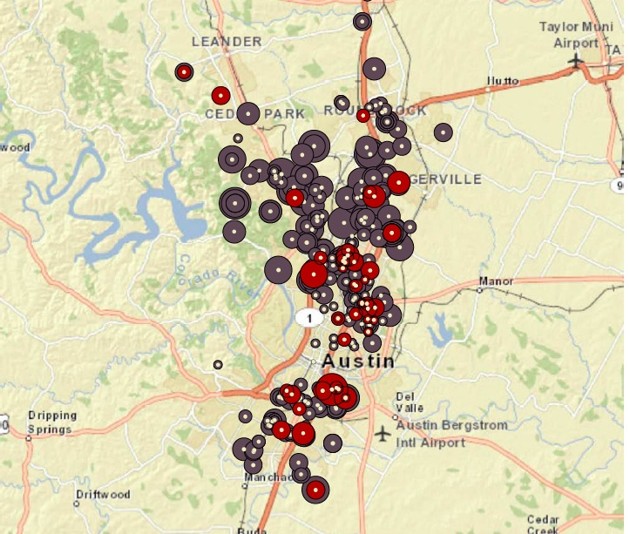

One study in Austin found that there were plenty of apartments around the city that voucher-holders could afford. But only a small portion of those apartments would rent to voucher-holders.

The report, by the Austin Tenant’s Council, found that 78,217 units in the Austin metro area—about 56 percent of those surveyed—had rents within the Fair Market Rent limits. But only 8,590 of those units accepted vouchers and did not have minimum income requirements for tenants. Most were located on the east side of Austin, in high-poverty areas with underperforming schools and high crime rates. (The survey only looked at apartment complexes with at least 50 units.)

“Families don’t have very many choices as to where they can actually use the voucher,” said Nekesha Phoenix, the Fair Housing Program Director at the Austin Tenants’ Council. “Although there are properties north and west that they could actually afford to live in, they can’t do it because the properties won’t take the voucher.”

Some cities have tried to prevent this. Last year Austin passed a “Source of Income” ordinance that prohibited landlords from refusing to rent to people solely because they have a voucher. And 12 states, as well as the cities of Los Angeles, San Francisco, Washington D.C., Chicago, and Philadelphia have all done the same.

But in Austin the landlords successfully pushed back. The Austin Apartment Association sued the city over the ordinance, asking for an injunction to block it. The apartment owners say that being forced to accept Section 8 meant more paperwork, onerous lease terms, and “burdensome inspections.” (Section 8 properties have to be inspected to ensure they are sanitary and safe.)

After a district judge left the law standing, the Texas legislature in May passed a bill banning any municipality from passing Source of Income ordinances. Source of Income discrimination will once again become legal in Austin when the state law goes into effect in September.

“A housing authority that on its own set out to use housing choice voucher as an instrument of desegregation would be brought to its knees by the elected officials of the cities that they’re in,” Daniel told me.

Why do some landlords try so hard to attract voucher-holders and others try so hard to avoid them? Section 8 tenants pay the rent reliably and stay in apartments for longer than market-rate tenants, according to Isabelle Headrick, the executive director of Accessible Housing Austin!, who is also a property owner. Though the apartment owners’ lobby had said that Section 8 requires landlords to sign a 400-page document and makes it more difficult to evict tenants, Headrick says that the contract is only 12 pages, and that the inspections required are “no more difficult than what a responsible landlord should be doing anyway.”

“Having Section 8 tenants makes my job easier, not harder,” she said.

But in Dallas, the Inclusive Communities Project found that some landlords who owned many units throughout the city would rent to voucher-holders in low-income neighborhoods, but not in high-income neighborhoods, even if the tenants could afford both apartments. Though the landlords would say they refused the vouchers because they didn’t want to deal with the paperwork, housing advocates say that property owners don’t want Section 8 tenants (read: minorities) in buildings because they might drive away market-rate tenants.

The Inclusive Communities Project sued HUD over the way it calculated Fair Market Rents in Dallas. It is now trying to make an arrangement with Dallas-area landlords so that it can rent apartments from them and then sublease them to Section 8 tenants, taking away landlords’ excuses for not wanting to deal with Section 8 paperwork. (Daniel also sued the Texas Department of Housing and Community Affairs over how it distributed tax credits for low-income housing, a case the Supreme Court will rule on in the next few days.)

“The idea that Section 8 people should be required to stay in areas of slum and blight—at some point they’re going to realize that’s just racial segregation,” Daniel told me.

Often, voucher-holders in Austin have such a hard time finding housing that they need to ask for multiple extensions to find housing. Tenants lose the voucher if they don’t use it in 60 to 90 days.

David Wittie, a voucher-holder in Austin, ran into this problem when he was looking for a new place last year. Wittie called around and found a few places that said they took vouchers. But by the time he got on a bus and arrived at the apartment building to sign a lease, the units would be rented. Wittie, who has been in a wheelchair since he contracted from polio in 1956, said that he had to ask for three extensions before he found a place.

“All I wanted was to find a nice place to live,” he told me.

In cities such as Austin, where rents are rapidly rising because of an influx of new, affluent residents, voucher holders may be having even tougher times finding a place to rent because the cost of housing has gotten so expensive. There are no rent-control laws in the state of Texas, and rents in Austin have gone up 7 percent over the past year, making it nearly impossible to find a place that is affordable with a voucher.

The result is that voucher-holders are pushed farther out from a city’s core, and into buildings that are dilapidated and have multiple code violations: In 2012, city enforcement officers ordered an apartment complex in Austin evacuated after a second-floor walkway sagged and then collapsed. Officials blamed termite damage, and said the low-income and Section 8 voucher-holders were hesitant to report unsafe conditions because they knew how hard it was to find an affordable place to live and didn’t want to be evicted.

Rufus Jones, a 51-year-old visually-impaired voucher-holder, had to look for a new apartment two years ago when the building where he’d lived for 13 years was sold to a new owner who quickly raised the rent. After months of searching, Jones moved into a place that soon became nightmarish when he discovered it was infested with cockroaches. The apartment was located in a noisy building where the hot water often didn’t work and where the sewage pipes leaked, but the final straw came when a roach crawled into Jones’s ear when he was sleeping and he had to go to the ER to get it out.

It took Jones a long time to find the place he now lives, since fewer and fewer apartments would accept vouchers. But when I visited him at the apartment, a low-slung building on the far north side of Austin, he told me it wasn’t much better.

His new place is infested with rodents, which crawl into his bedroom and bathroom through holes in the wall, waking Jones’s service dog and Jones himself. Jones’s current place is only on one bus line, and he’s now once again going through the process of finding his way around a new neighborhood.

“It’s just so horrible right now—I can’t sleep, and I’m stressed out the whole time,” he told me.

* * *

The Housing Choice Voucher program is the nation’s largest housing subsidy, serving 2.2 million families, which is still only about 25 percent of eligible households. It makes up a big part of the government’s efforts to improve housing conditions for America’s poorest families. Advocates have called time and again for HUD to alter the Housing Choice Voucher program to make it a better tool for families to improve their lots in life, and some changes are afoot.

“There’s a growing recognition that there’s a shortage of affordable housing, and that families with vouchers have a hard time using them in neighborhoods and communities that haven’t traditionally had voucher families in them,” said Phil Tegeler, the executive director of the Poverty & Race Research Action Council.

As the result of a settlement, HUD tested a new program in Dallas and a few other metro areas that calculates fair market rent based on zip codes, rather than for a metro area as a whole. Called the Small Area Fair Market Rent Program, the idea is to make the voucher more valuable to landlords in nicer neighborhoods. Under the program, if a voucher holder wants to rent a place in the 75231 zip code, the Vickery Park area of Dallas, the voucher would support a rent up to $580 for a one-bedroom. Vickery Park is a lower-income area that gained notoriety as the home of America’s first Ebola victim. But if a voucher holder wants to rent an apartment in Forney, Texas, zip code 75126, the voucher would cover rent of a one-bedroom up to $1,090. Forney has some of the lowest crime rates in the state, and has also been designated the “Antique Capital of Texas.”

(Alana Semuels)

A study out of Harvard’s Joint Center for Housing Studies found that the Dallas small-area fair market rent program was successful in helping voucher families move to neighborhoods with lower violent-crime rates and lower poverty rates. Kathy O’Regan, HUD’s Assistant Secretary for Policy Development and Research, told me that the results of that study motivated HUD to use small-area Fair Market Rents in more areas. Earlier this month, HUD sought comments the idea of potentially changing the way Fair Market Rents are calculated.

“We agree with critics—we believe that we should be able to do better,” she told me. “It doesn’t look from geographic patterns as though households are getting enough choice.”

A HUD study also found that public housing authorities are significantly underfunded when it comes to managing Section 8. Administrative costs, which are used to pay for mobility counseling, have been limited by Congress. HUD is asking Congress to consider changing the limits on administrative costs for voucher programs.

“We want to give households choice, choices that help them in improving their lives,” she said.

If Section 8 can be fixed, it’ll be money well spent. The government spends billions of dollars each year creating a program that, for some families, is akin to winning the lottery. But what’s the point of winning the lottery if there’s nowhere safe to spend it?

We want to hear what you think about this article. Submit a letter to the editor or write to letters@theatlantic.com.

How Silicon Valley Made Big City Housing The Cause Of And …

Silicon Valley Has a Homelessness Crisis | The Nation

- (REPAIRING SILICON VALLEY) The WHITE HOUSE And The PAY-TO-PLAY Bribery Corruption

- (REPAIRING SILICON VALLEY) Ending The Bribes Silicon Oligarchs Pay To Your Public Officials

- (REPAIRING SILICON VALLEY) ***** Silicon Valley Created A Huge Part Of The Housing Crisis

- (REPAIRING SILICON VALLEY) Google Is Far Worse Than Any Citizen Can Possibly Imagine

- (PORTFOLIO) The $200,000.00 Home! Want One? HERE IS THE OFFER

- (WORLD NEWS) When Is a “Charity” Really Something Bad?

- (WORLD NEWS) SAN FRANCISCO IS RULED BY DRUGS AND CORRUPTION SAY PARENTS

- AMERICAN CORRUPTION –

- In Marin County, California, The County Officials Cut Off Your Benefits If You Say Something the Officials Disagree With –

- San Francisco has become a stinking hell-hole of urine, feces and mindless hipsters: What went wrong?

- Texas launches effort to have DHS order illegal immigrant processing center and affordable government housing be built on top of San Francisco’s Union Square

- San Francisco’s Billionaire Douche Bags Bankroll Attack On Poor People

- Senators call for DOJ investigation of Wells Fargo

- VISA FRAUD FACTORIES IN SILICON VALLEY. “GREEN” BILLIONAIRES LIE CHEAT AND STEAL FOR “GREED”

- FBI AND FTC ASKED TO INVESTIGATE SILICON VALLEY MAFIA

- Millenials Boycott Home Buying. No more Babies, No More Mortgages, No More Bank Schemes

- How Elon Musk Destroyed America’s Solar Future.

- Who Is California’s New Green Cleantech Czar Gary Kreman?

- Rich Google yuppie execs and Tech Bros Want Homeless People Destroyed

- Maybe You Heard: The System Is Rigged

CHECK BACK OFTEN, NEW POSTS FROM THE PUBLIC ADDED ALL THE TIME...

THE POLITICIANS WOULD PREFER THIS PLAN TO SOLVE THE CALIFORNIA HOUSING CRISIS: