Fudging EVs Battery Mileage

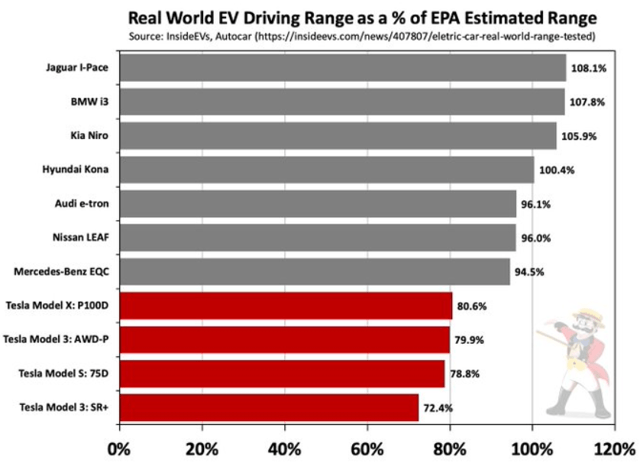

One of the critical myths that many hold to be true is that Tesla has a serious advantage in battery mileage.

This write-up looks at Tesla’s reported battery performance results versus performance in real world driving tests, and versus its results in the tests supervised by the Environmental Protection Agency (“EPA”). Tesla’s relative performance is compared to the relative performance of other manufacturers. Some of the tests and reported results look at the fully-charged range and others address issues of efficiency. Some of the tests and reported results are done under highly controlled conditions, whereas others are less rigorous.

The following tables summarize the results from all the comparative tests under controlled circumstances that the author was able to find:

Comments

- Note that there is not a single test where any other brand did comparatively worse than

any Tesla. - Multiple tests and multiple forms of tests all show the same results: Tesla

underperforms its EPA ratings materially, consistently and uniquely. - Tesla has responded to the Autocar/What Car? results by claiming that the failure to

fully drain the battery invalidates the test. But multiple other tests that show full

draining produce the same results. - Highway results are likely to be most relevant since this is the type of driving where

range is most important.

Additional evidence: The EPA test versus the WLTP test

- The EPA test is the standard in America. Elsewhere, the World Harmonized Light Vehicle

Test Procedure (“WLTP”) is used. Both are government-authorized and highly controlled

tests. The WLTP test consistently produces longer range results than the EPA test. - An analysis of all 10 vehicles (including 3 Tesla’s and 7 other brands) for which the author

was able to find comparable results shows that the average ratio of the ranges

produced by the tests (EPA/WLTP) is 83% for the Tesla’s versus 93% for the other brands.

However, unlike the controlled, comparative tests reported above, there is greater

variance of the results and some non-Tesla brands have results lower than some Tesla’s. - Since it is difficult to “game” two very different tests at the same time, this is evidence

that Tesla is looking to optimize results on the EPA test.

Three professional testers/automotive writers (Edmunds, The Drive, Road & Track) have all commented on this subject. These authorities all come to the conclusion that Tesla materially, consistently and uniquely overstates its range. Here are some representative quotes:

“I’m tired of this. I am not able to match, let alone exceed, the Tesla’s rated range. This flies in

the face of every other EV…. I’m thinking [Tesla’s] ratings are overstated. Of course they are.” (Edmunds)

“But Tesla’s numbers have never really made sense to me either. These are great cars, but I can tell you that there’s no universe in which a Tesla can approach its EPA ratings in real-world driving.” (The Drive)

“It seems Tesla optimizes its cars for the EPA test, which gives them range numbers to brag about on paper—numbers that owners I’ve spoken with can’t seem to reach.” (Road & Track)

Spritmonitor.de is a German website where car owners can input their actual consumption results for both EVs and ICE vehicles. This is obviously not a controlled result. However, if Tesla’s had materially more efficient EV Drivetrains, you would expect to see a systematic difference between Tesla’s and other brands in the website’s measure of efficiency (average kWh consumed per 100km of driving). Adjusted for the weight of the vehicles, which is admittedly a very crude standard, there appears to be no material difference.

Tesla’s contain a GPS feature that directs that driver to the nearest Supercharging station. The feature also shows whether the driver has sufficiently battery charge to make it to the station. To make this calculation, Tesla uses data crowd-sourced from Tesla cars. The results imply battery ranges much closer to the shorter real-world results than the EPA results. This belies the claim from many Tesla bulls that the other tests are biased against Tesla.

Conclusions

In the real world, Tesla’s do not have a material technological advantage in the company’s EV Drivetrains. Although Tesla’s range and efficiency results are as good as, but not materially better than, other manufacturers, this “advantage” needs to be tempered with the following considerations:

- There are clear indications that Tesla uses technologies, such as battery chemistries and

configurations, which are inherently less safe than those used by other manufacturers

but which produce higher power densities. Other manufacturers are not willing to make

this trade-off versus safety. - There are also clear indications that Tesla uses technologies that are less reliable and

durable than those used by other manufacturers. The range of Teslas seems to decline

faster than other brands with use, Teslas very quickly go into “limp” mode to avoid

overheating (like in the quarter-mile races in this test), and Teslas quickly reduce

charging speeds. All of these are indications of EV Drivetrains optimized for short-term

“bragging” results rather than long-term performance and customer satisfaction. - It has to be remembered that Tesla’s are designed from the ground up to be EVs,

whereas most of its competitors to date are general models that have an EV Drivetrain

option. The ground-up designs should be more efficient. Tesla’s more recent

competitors, which are not included in these test results, are starting to be ground-up

designs and therefore should perform relatively even better.

As is so often the case with Tesla, a seeming technological advantage is just Tesla’s willingness

to be more reckless and short-sighted than other companies.

It is clear that Tesla is “gaming” the EPA test. Although this is probably done to a degree by all manufacturers, it is clear that Tesla is doing this far more aggressively than other manufacturers. This is another case where Tesla is not better, merely more reckless.

Full Self-Driving is a Lie

Tesla is not now, nor has ever been, a leader in the pursuit of autonomy.

In fact, Tesla is not even dedicating resources to full autonomy- they are merely bootstrapping their Level 2 Driver Assistance Systems to try and catch up to Musk’s vacuous promises about their so-called Full Self-Driving product. To understand how much of a crock Tesla’s pursuit of autonomy is, one first needs to understand the less-than-illustrious history.

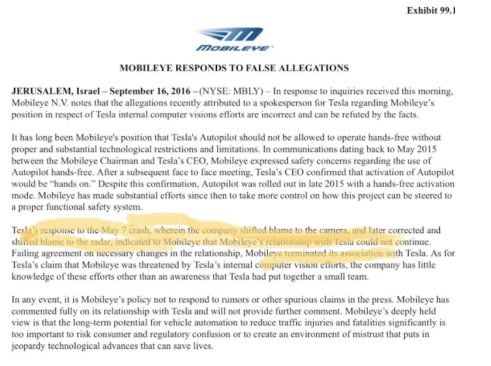

In 2016, Tesla was using Mobileye vision systems in its cars. Tesla Driver Assistance was the most advanced on the road at the time, but it wasn’t their technology, it was Mobileye’s. Worse, it was the most advanced because it was being used dangerously, using drivers as guinea pigs in ways any other OEM & Mobileye itself were uncomfortable with. This isn’t better technology, its willingness to use existing technology in more dangerous ways- a pattern that permeates Tesla at large.

In 2016, Mobileye got so concerned with Tesla’s misuse of their technology, they fired Tesla as a client. Tesla claimed it was because Tesla itself was developing competing technology, but they did so by PR leaks. Mobileye put in a signed SEC filing that, in fact, they broke up with Tesla due to Tesla misuse of its technology. Tesla never formally responded because they could not, as Mobileye was speaking the truth.

Sadly, Tesla continues to this day the very unsafe practices being undertaken by Tesla. In middle of trying to close the self-dealing SCTY merger and losing its partner, Tesla in October 2016 declared all cars were now “Full Self-Driving”- a claim that Tesla even now acknowledges is false.

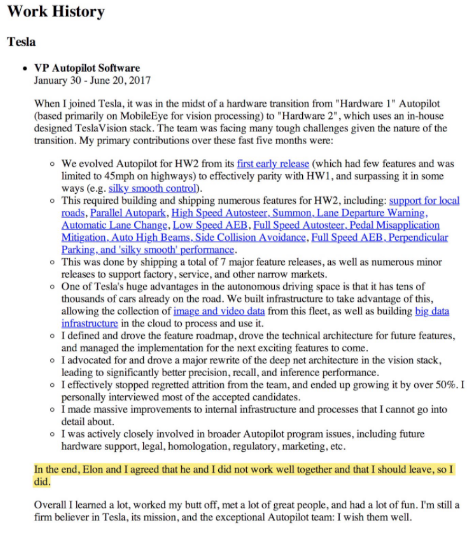

In fact, at the time Elon/Tesla was making this claim, Tesla lacked even a basic data collection ability to work on autonomy & those working on Tesla vision were fleeing in droves due to Elon’s negligent promises. Here is the resume of Chris Lattner, brought in to head Tesla’s effort in January 2017, speaking to these truths.

Since then, Tesla has just bootstrapped its existing technology in minor improvements with no discernible advantage. Which brings us to LIDAR, widely considered necessary for autonomy & used by SpaceX for critical spacing needs a la space shuttle docking.

Not based off of any scientific evidence of any kind, Tesla and Musk began making the claim that LIDAR was not necessary for autonomy. Every single person that has been senior at Tesla working on autonomy disagrees. They have all left for LIDAR based autonomy companies- or at least companies that include LIDAR in their development.

Because Tesla sells autonomy, and has collected many hundreds of millions, they have to keep the dream alive. Musk pretends there’s regulatory hurdles, but Tesla itself acknowledges that’s a lie.

Here is discussion of a study by Navigant Research, which shows the reality of where Tesla actually ranks on self-driving. The report concludes that

“[T]he performance of [Tesla’s] systems remains inconsistent and its products do not match its proposed mobility business model.

https://www.cnet.com/roadshow/news/self-driving-study-navigant-research-tesla-waymo-cruise/

And here is another recent report on Tesla’s Autopilot safety: https://teslanorth.com/2020/10/02/tesla-autopilot-ranked-poorly-european-assessment/. Furthermore, don’t forget about the many (deadly) crashes that have involved Tesla’s – it’s getting so bad that even the NHTSA is finally ramping up their investigations.

In February 2021, Ed Niedermeyer did an excellent job summarizing the timeline of Tesla’s journey towards self-driving from 2016-today in this Twitter thread. Niedermeyer’s points and more are also given, along with original analysis of the misleading data from the recent safety “transparency” report Tesla issues somewhat regularly, in this excellent video:

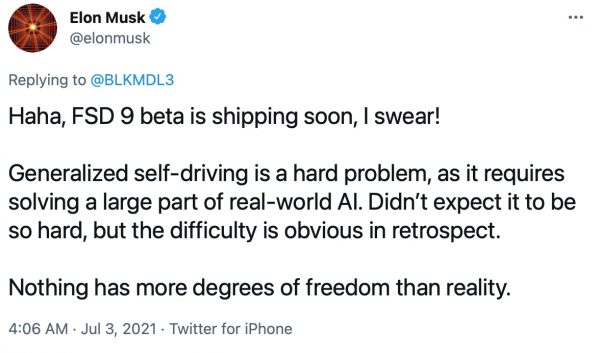

And wouldn’t you know, in July 2021, Mr. Musk himself finally had the humility to admit this very point:

The Cost of Owning a Tesla

Tesla sells itself on lower cost of ownership due to fewer parts. Nothing can be further from the truth.

Tesla has history of laundering both new and used lemons in the US and abroad. They were sued for this practice by a whistleblower who had knowledge of and was told to participate in more than one distinct scheme to do so. Tesla settled that case pursuant to an NDA. Typically, when a company employee sues the company for fraud, the company doesn’t settle. See this article for more details: Tesla Resells Defective Buyback Cars Abroad

Perhaps even more telling is how Tesla insurance rates are the HIGHEST in the industry. Tesla’s “new” (the image below is from 2016) insurance product is just a way to make the company seem like they are addressing something that they cannot. Teslas are involved in accidents > 2x ICE vehicles and more than any other EV. That’s not good for cost of ownership. In 2018 in Norway, where statistics are available for the whole country, a staggering 20.4% of Tesla’s owners were involved in a collision vs 13.5% for other EV’s & 9% for ice cars.

Why are Tesla’s so expensive to insure? One of the reasons is their abysmal build quality. Below are a few articles and some photos collected to give the reader a sense of the issues surrounding build quality.

What Experts Think Of Elon

Elon Musk is a charlatan, not a genius, and possesses no genius or expertise outside of marketing, sales, and pushing propaganda.

In fact, much of what you are led to believe about him is false:

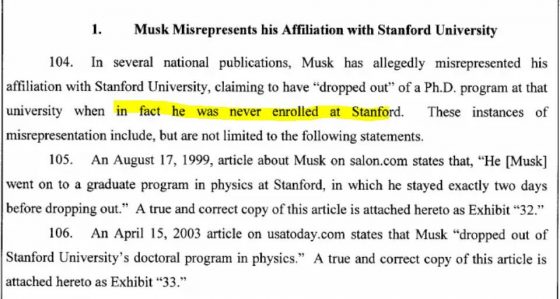

Musk transferred in to Penn from Queens University in Canada – the easy way for admission to an Ivy League – and then took extra time to graduate. No record of him ever being accepted by Stanford, let alone attending AND dropping out, has been produced. His status in terms of Stanford was even challenged in court by one of the REAL founders of Tesla:

Musk is not a founder of Tesla. He bought his way in then sued for the “co-founder” title. He’s not even legally allowed to call himself the founder, so on any Tesla literature or background, you will see the “co-founder” purchased title. Here is an article detailing this fraud

Musk is not a founder of Tesla. He bought his way in then sued for the “co-founder” title. He’s not even legally allowed to call himself the founder, so on any Tesla literature or background, you will see the “co-founder” purchased title. Here is an article detailing this fraud

The most charitable explanation is that Musk sits in the hazard phase of knowledge on every topic. Here’s a great article from December 2018 highlighting that if you have expertise in a topic, you know that Musk does not. It explains that Musk is full of it on the following topics:

- Reusable rockets

- Flying from NY to Shanghai in 30min

- Colonizing Mars

- Hyperloop

- Neuralink

- Tunnels

- Autopilot

- Thai Cave fiasco

Just in 2020, Musk has annoyed experts on Covid and Artificial Intelligence with his misinformation and lack of understanding…

Covid:

- Musk Either Bad Liar or Doesn’t Know What a Ventilator is

- Musk Coronavirus Mansplaining

- And of course, lest we forget:

AI:

Dr. Lara Jones, an ICU MD, pleaded with Musk on Twitter to “stay in his lane.” It’s not that Musk needs to stay in his lane, it’s that when Musk delves into yours, you realize he’s a charlatan. What she says about his comments on lung capacity are equally true of 90%+ of his claims. Most people just take his word for it when it’s not their wheelhouse.

Sociopathic Tendencies

Musk is a narcissistic sociopath. On the Joe Rogan program, Musk endorsed a specific “life is a simulation” theory- one that isn’t cute but custom tailored to justify his abhorrent behavior. No, this isn’t about being a geeky scientist, this is about justifying caring less about others. The Robin Hansen text that created the theory Musk subscribes to states in its header, “if you might be living in a simulation, then all else equal you should care less about others.” Read on, and you will see how Musk chooses to live. Like nihilism, the simulation theory is just an excuse for sociopaths.

No one is spared from Musk’s inner sociopath

- Wives – “I am the alpha” he said to his first wife at their wedding reception

- Employee – “I will nuke you” as an employee who he tried to retain quits

- Citizens – no one else “beta tests” lethal software on unsuspecting roads, see TeslaDeaths.com for the fallout & deaths

- Citizens again – Tesla uses buyers as guinea pigs & avoids pre-production testing because it’s better for the stock price, bro

Even in the fawning and flattering Ashlee Vance access biography-

“Elon’s worst trait by far, in my opinion, is a complete lack of loyalty or human connection. Many of us worked tirelessly for him for years and were tossed to the curb like a piece of litter without a second thought” ~unnamed Tesla employee

One of the best examples of Musk’s tendencies are in how he dealt with whistleblower Martin Tripp. Not only did he call himself out as a sociopath when trying to call Tripp one, the real kicker is detailed beautifully in this Bloomberg piece.

He has quite a history with whistleblower’s, as outlined in this Twitter thread detailing numerous cases of immediate termination upon contacting the ethics hotline or Musk himself.

In a more comical yet still disturbing displays, the following YouTube video uses multiple sets of criteria for psychopathy to analyze Musk – you can guess what the conclusions were:

This just scratches the surface of the evidence showing Musk as a sociopath. The majority of this evidence shows up via the many tenets of Tesla’s fraud covered throughout the website, undoubtedly championed by Musk himself.

The SolarCity Scam

The acquisition of SolarCity by Tesla in 2016 is perhaps the most blatant act of self-dealing of this market cycle.

In an all-stock transaction, Tesla shareholders, led by Elon Musk, bailed out SolarCity as it teetered on the edge of bankruptcy. A full accounting of the history of that transaction is not yet possible, but the evidence accumulated thus far leads to one inescapable conclusion: Elon Musk brazenly engineered the rescue of SolarCity at the expense of Tesla shareholders because failing to do so would have jeopardized his entire empire, including SpaceX, his personal wealth, and the wealth of many of his family members. He bluffed, exaggerated, lied, invented fake products, and ultimately pulled off the transaction and lived to fight another day. His behavior during this crisis follows a recognizable pattern that has repeated itself on at least two other occasions since.

Given the egregious nature of what transpired, the SolarCity bailout has spawned several class action lawsuits by shareholders. The most notable of these is the shareholder derivative lawsuit currently ongoing on the Delaware Court of Chancery. Thanks to the tireless work of the PlainSite organization, the case docket can be found at the link below. The case documents include many that Musk and his team of lawyers have tried to keep confidential. It does not take much exploration of these documents to see why.

Delaware Court of Chancery Case Docket

In mid-2018, a ruling by Vice Chancellor Judge Joseph R. Slights III denying the defendant’s motion to dismiss was made public. In what turned out to be a very notable thread, Tesla critic @TeslaCharts posted a detailed analysis comparing what the ruling revealed about Musk’s many deceptions to his public statements and investor communications. The thread went semi-viral after it was reposted in its entirety on the website run by Zerohedge. Musk himself engaged the @TeslaCharts account directly a few days later – clearly, the thread had stuck a nerve. The original thread can be found here:

TESLAcharts Twitter Thread

The core conclusions from the thread are simple: SolarCity was insolvent and Elon Musk and the board members at all three of his companies knew it. Strikingly, Musk used SpaceX money to prop up SolarCity until Tesla could save it. He directed SpaceX to purchase $255 million worth of SolarCity bonds, a stunningly reckless move that ultimately tied the fate of Musk’s entire empire to SolarCity. Had SolarCity failed, they would have defaulted on those bonds. Since SolarCity was a financial engineering company at its core, recovery value in bankruptcy would have been minimal. SpaceX, itself struggling to create a sustainable business at that time, would have been a casualty of a SolarCity filing. Musk and his family members would have defaulted on personal lines of credit, triggering cascading series of defaults leading to financial ruin for all involved.

The desperation to get the deal done caused Musk to pull a Theranos-style fake product demonstration – the infamous solar shingle reveal of October 28, 2016. To sooth anxious investors, Musk stood in front of the world and proclaimed a breakthrough. As reporting by FastCompany would later confirm, the product was fake. The entire event was held on the set of Desperate Housewives, none of the shingles on display were functional, and the entire event came as a surprise to the teams within SolarCity and Tesla working on the project. (See Inside The SolarCity Fake Product Demo for the whole story.)

As more lawsuit documents came to light, the depth and extraordinary nature of the many conflicts of interest among the directors at SolarCity, Tesla and SpaceX became clear. These conflicts are laid especially bare in the in the deposition of Kimbal Musk who, despite being a board member of SolarCity, Tesla and SpaceX, claimed under oath to have no conflict of interest. Notably, as the Tesla board was pondering whether to acquire SolarCity, Kimbal Musk was facing numerous margin calls on loans backed by pledged SolarCity stock. The deposition shows that the Musk brothers made a mockery of corporate governance. Laws don’t matter if you win and losing wasn’t going to be an option.

In another notable thread, this time posted in October of 2019, @TeslaCharts once again exposed the sheer comedy of it all: TESLAcharts Twitter Thread

(first of eighteen tweets!)

Ultimately, all the directors of Tesla except Elon Musk settled the derivative lawsuit in Delaware for a payment of $60 million. Elon Musk continued to fight the case, which was been delayed several times because of the COVID-19 outbreak. As Jim Chanos notes, share price is the ultimate prosecutor and defense attorney, though the plaintiff’s lawyers in this case have shown some chops. Keen analysis of Musk’s testimony from the Chancery courthouse is provided by YouTuber Common Sense Skeptic with their Musk on Trial series:

With Tesla’s stock still in the stratosphere and the judgment uncertain, Elon Musk seems likely to escape the consequences of the sordid SolarCity affair, at least for now. Time will tell if history will be just as kind.

Tesla to Face Deluge of EV Competition

For most of the time since Tesla began delivering the Model S eight years ago, Tesla has enjoyed sole possession of the luxury EV market.

Is this because they are lightyears ahead of the other auto manufacturers? Were other auto manufacturers simply not as nimble, innovative, and disruptive as Tesla? Or, have they been preparing to release EVs for years, but didn’t want to introduce money-losing cars into market until regulations kicked in that made it a necessity? These are the questions we will explore in this piece. Hint Hint, its the latter.

In the U.S., EVs receive generous tax credits and subsidies, but the limited scope of California’s Zero Emission Vehicle (ZEV) credit scheme was not broad enough to force OEMs to introduce EVs at scale. And, until recently, while China offered generous subsidies for EVs, it did not impose emissions caps or other mandates.

Video from WSJ

Europe, however, is an entirely different matter. Several years ago, the EU formulated policies that implement mandatory CO2 emission targets for new cars. Those regulations began to be phased in this year (2020) and will reach full force in 2021. Quite predictably, most OEMs held back on introducing EVs until 2020 and 2021. Suddenly, this year, for the first time, Tesla has faced a deluge of competition in the European Union. Two years ago, there were only three other EV choices. Last year, the number increased to 11, though with production numbers choked back in anticipation of the 2020 inception of the EU’s emission standards.

By the end of 2020, there are expected to be 28 new EV offerings on sale, most of which will appear in the second half of the year. And, in 2021, another 18 new EV launches are scheduled, bringing the total number of Tesla rivals to 57.

For the first time, Tesla faces (at least in Europe and China) the kind of intense competition other OEMs have always faced. And it does so with limited product offerings. The Models S and X are already stale; despite price cuts and added content, both their market share and their absolute numbers have plunged. Tesla has no luxury EV offering on the horizon to replace either of them, and is already ceding the luxury and performance EV markets to Jaguar, Audi, Mercedes, and Porsche.

In the middle market, Elon Musk’s forecast that the Models 3 and Y combined eventually would achieve annual unit sales of two million seems highly improbable. In Europe, Model 3 sales are dropping off even before the arrival of the Model Y. And, in the U.S., Model 3 sales have peaked, and evidently are being cannibalized by Model Y sales.

Either because of Elon Musk’s over-confidence in Tesla’s current model line-up or weak product planning, Tesla has no new models coming out in 2021. This will hurt.

Of the 28 new EV launches this year and the 18 next year, there are 16 models that should easily give Tesla a run for their money. They include sleekly styled models from Audi, BMW, Polestar, Rivian, Volvo, and VW, with prices ranging from $33,000 to $96,000 and with ranges averaging 294 miles (470 Km).

Many of these models will not show up in the U.S. because, as noted, right now it is the EU and China which have the strict emission laws that all but force OEMs to make EVs and hybrids. Thus, VW’s first true EV, the ID.3, will not be sold in the U.S. VW has roughly half of its sales in the EU and the other half in China. VW finds it far more financially sensible to focus its EV production on the EU or China.

Which underlines a key point. VW may well only break even or, indeed, lose money on its EV sales in the EU and China. However, producing the low-margin or no-margin EVs enables VW to continue to profit from its internal combustion line. Tesla, with only an EV line, is forced to compete against other OEMs who find it economically sensible to, at best, break even on EVs. Tesla will continue to have the U.S. market largely to itself. However, in the U.S., Tesla’s sales have flattened and its revenues are declining. The obvious solution would be a significant refresh or full-model change.

Most carmakers conduct full-model changes every four to five years (and, if they aren’t doing full-makeovers, they launch new products). Full-model changes are costly, at roughly $500 million per model, but if executed properly, can reinvigorate demand for an old model. A prime example is Porsche’s Panamera, which saw global sales sink down to 15,240 units in its seventh year, but more than doubled to 38,443 units two years after its 2016 full-model change.

In 2021, Tesla’s Model S will be nine years old, its Model X will be in its sixth year, and the Model 3 (80% of global sales over the past four quarters) will be five years old. Yet Tesla has planned no full-model changes for the 3/S/X. It will be no surprise if Tesla continues to cut prices on these models in order to keep the factories running. Price cuts lead to lower residual values, and lower residual values cheapen a carmaker’s brand (Nissan, with its high incentive spending, is the perfect example).

While some might say that the Model Y should lead Tesla’s global sales growth, this too seems doubtful. Not only does the Model Y cannibalize sales of the Model 3 and Model X, but at least four of the EVs being launched in Q4 2020 and early next year are new models specifically aimed at competing with Tesla’s Model Y. The first will be VW’s ID.4, which is now on order in Europe, and will begin deliveries before the Model Y ever reaches Europe’s shores. Because of this, 2021 could be a year where Tesla returns to burning mountains of cash and is viewed as a struggling competitor rather than a market leader.

Further Reading

Is Elon Musk really a genius? Are Tesla cars, Tesla Solar, Tesla Unicorn Fart apps cutting edge tech? And has Tesla finally turned a profit with them? Think again.

Sorry, But Tesla’s Cool Electric Cars Can’t Compete As Long As Fracking Exists

If you were among the brave few who bought a Tesla Roadster in 2008, you purchased your government-subsidized $100,000-plus electric car when a barrel of oil cost as much as $162 in today’s dollars. “Peak oil” was an article of faith — as crude supplies ran out, ever-higher oil prices would destroy demand for the internal combustion engine and other fossil-fuel monstrosities. But now, if you’re one of the 500,000 wannabe Tesla owners who, according to CEO Elon Musk, has put down a $1,000 deposit on a $35,000 Model 3, the company’s new mass-market electric sedan, you’re probably just as familiar with a fashionable new green conceit. Now the article of faith is “peak demand” for oil, the idea that electric cars will soon make oil obsolete.

You can read the full article here.

Tesla is making a risky move by issuing $1.5 billion in debt

• Tesla said it would issue $1.5 billion in unsecured notes.

• Issuing new debt deviates from previous equity-based capital raises.

• The carmaker has added substantial debt to its balance sheet since its SolarCity merger last year.

Continue reading “Tesla is making a risky move by issuing $1.5 billion in debt”

Elon Musk Had a Hilarious Response to More Than 60,000 People Canceling Their Tesla Model 3 Orders

The Tesla Model 3, the mass-market electrical vehicle that may completely change the automotive industry, is here-and people are excited.

Well, most people, anyway. There are more than a few customers who are also disappointed.

About 63,000 people have canceled preorders for the electric car over the course of the past year, as revealed earlier this week by Tesla CEO Elon Musk on the company’s quarterly earnings call. (The number of orders dropped from about 518,000 to 455,000, Musk said.)

63,000 People Decided Tesla Cars Aren’t Worth Buying

During a quarterly earnings call on Wednesday, Tesla CEO Elon Muskannounced that about 63,000 people have canceled their Tesla Model 3 orders over the past year.

Continue reading “63,000 People Decided Tesla Cars Aren’t Worth Buying”

Tesla Reports Losses

The electric-car maker lost $0.69 per share on an adjusted basis. This was the first earnings release since shareholders approved the electric-car maker’s acquisition of SolarCity — a $2.6 billion deal that merged the two companies CEO Elon Musk oversaw.

As Tesla continues to burn through cash and tackle competition, analysts are parsing the earnings release and call for information on how the company plans to manage its capital.

Yes, Elon Musk Is Actually Really Boring

Musk is a serious person, but he can also be something of a loose cannon, making outlandish statements designed to troll the press or simply amuse himself. In a 2015 interview with Stephen Colbert he semi-seriously endorsed dropping nuclear weapons on Mars; last year he implied on Twitter that he’s developing an Iron Man-style flying suit for the Pentagon. Most reporters assumed that the tunnel thing was another one of his jokes.

Musk wouldn’t seem to be in a particularly good ideological position to benefit from Trump’s infrastructure largesse. He’s a climate change hawk who was so closely identified with the Obama administration that Mitt Romney attacked Tesla during the 2012 debates. (Tesla had received a government-guaranteed loan in 2010.) In the next presidential election, Musk supported Hillary Clinton for president, describing Trump, in an interview with CNBC, as a man who “doesn’t seem to have the sort of character that reflects well on the United States.”

Elon Musk, UAW spar over Tesla plant conditions

The United Auto Workers signaled Friday that it’s gathering support to unionize Tesla’s assembly plant after someone claiming to be an employee of the automaker publicly criticized the company over factory conditions.

The UAW confirmed Friday that Tesla workers “have approached the UAW, and we welcome them with open arms.”

The union said those workers included Jose Moran, who published a blog post Thursday on a site called Medium alleging that “preventable injuries happen often,” workers are forced into “excessive mandatory overtime,” dissent is stifled and compensation is inadequate.

Tesla customers cancel Model 3 orders over Musk Flip-Flopping

No fewer than five Tesla customers told BuzzFeed Monday that they’ve canceled plans to purchase the car maker’s highly anticipated Model 3 after Mr. Musk agreed to participate in two White House advisory groups, particularly in light of the president authorizing a broad executive order last week limiting the intake of refugees and restricting immigration.

Despite telling CNBC prior to Election Day that Mr. Trump was “not the right guy” for the White House, the 45-year-old South African-born entrepreneur has since accepted roles on the president’s economic advisory group and manufacturing council.

Tesla Aims to Cut Crashes (And Misses)

Musk was expanding on a report published last week by the U.S. National Highway Safety Administration that not only exonerated AutoPilot of having a role in a fatal crash in Florida last summer but added that airbag deployments indicated that the crash rate had fallen nearly 40 percent, to 0.8 per million miles driven, down from 1.3 per million miles before the original version of AutoPilot was installed.

The fatal crash had cast a pall over Tesla’s system, prompting some critics to say that the company had overpromised simply by choosing the name AutoPilot. Tesla acknowledges that AutoPilot is not—yet—a truly autonomous system but rather a package of driver-assistance features, such as emergency collision avoidance, lane keeping, and active cruise control.

On Saturday Musk warned customers who were about to have access to the newly downloaded software package that there might be a need to adjust the hardware—specifically the angle of the cameras.

Stop Elon Musk from Failing Again is an initiative launched by the Sunlight Project, under Citizens For The Republic, to root out corruption, fraud and abuse of taxpayer of money in major corporations. Elon Musk has defrauded the American Taxpayer out of over $4.9 Billion in the form of subsidies, grants, and other favors. We are challenging not just Elon, but the entire culture of corporations making billions of dollars off of the American people for almost zero return to the consumer. CEO’s like Musk are taking advantage of Americans, and it is our intention to end their free ride.

StopElonFromFailingAgain.com is a collection of sources and news meant to inform and develop an understanding of Elon Musk, Tesla, SolarCity, and SpaceX. Unless stated, articles are not our content but that of those around the web. We do not take credit for any article unless stated.

Click below to find out more about the Sunlight Project:

You must watch this Elon Musk video of rocket fails

Any time Elon Musk makes a mistake, it does not come cheap.

That could not be more true when it comes to SpaceX, the aeronautics company he runs. On Thursday, Musk shared a video highlighting what happens when you fail to land an orbital rocket booster.

And it is spectacular.

“Long road to reusability of Falcon 9 primary boost stage…When upper stage & fairing also reusable, costs will drop by a factor >100,” wrote Musk.

The video consists of a lowlight reel of SpaceX, featuring a lot of rockets blowing up with captions like “Rocket is fine? It’s just a scratch.”

Read the full article here

Elon Musk’s Martian Waterpark

In case you haven’t heard, Elon Musk is very rich. As someone who grew up in the Hamptons, I know that rich people can afford to have bonkers-ass dreams and convince people they’re good ones. Musk’s ambition to send crewed missions to Mars in the next 10 years is a bit ambitious. But even that seems reasonable considering his ultimate goal of sending thousands of everyday people to and from Mars on a rocket that hasn’t been invented yet.

That said, could Elon Musk finally get to play Martian overlord by the 2060s? I’ve seen more impossible things happen in the last two months alone. Also, telling people they should be prepared to die to fulfill his pipe dream is pretty shitty marketing.

Yes, Elon Musk Is Actually Really Boring

Musk is a serious person, but he can also be something of a loose cannon, making outlandish statements designed to troll the press or simply amuse himself. In a 2015 interview with Stephen Colbert he semi-seriously endorsed dropping nuclear weapons on Mars; last year he implied on Twitter that he’s developing an Iron Man-style flying suit for the Pentagon. Most reporters assumed that the tunnel thing was another one of his jokes.

Musk wouldn’t seem to be in a particularly good ideological position to benefit from Trump’s infrastructure largesse. He’s a climate change hawk who was so closely identified with the Obama administration that Mitt Romney attacked Tesla during the 2012 debates. (Tesla had received a government-guaranteed loan in 2010.) In the next presidential election, Musk supported Hillary Clinton for president, describing Trump, in an interview with CNBC, as a man who “doesn’t seem to have the sort of character that reflects well on the United States.”

Beware of Elon Musk, Who ‘Didn’t Build That’

The truth is that Musk went rent-seeking with the government by way of his network, got a loan to demonstrate that Tesla was an operational company with real possibilities, and used that fact to go to Wall Street to raise capital. It is a lot easier to raise capital when you have the federal government demonstrating it believes in you.

But hey, it’s not like Musk and Obama are buddies. Then again, they did have dinner in February 2015, Musk donating almost $36,000 to the 2012 Obama Victory Fund, and another 30 grand to the Democratic National Committee.

This back-scratching feels like it extends to SpaceX. On Sept. 1, its Falcon 9 rocket exploded on the launch pad during a test run. It took less than four months for the FAA to approve SpaceX’s explanation for the explosion and to schedule a new flight.

Four months?

Remember how NASA flipped out after any mishap involving the space shuttle, and would ban flights for years until they figured out what was wrong? As of now, SpaceX is privately funded. Yet the obvious capital injection by the government seems inevitable. After all, the government can outsource any of its orbital needs to SpaceX, which would naturally mean offering it a massive loan in order to hasten that process. With this week’s successful launch, get ready for more government money for Musk.

SpaceX lost a quarter of a billion dollars after one of its rockets blew up

“The company lost $260 million in 2015 when one of its Falcon 9 rockets, carrying two tons of cargo to the international space station, exploded shortly after liftoff,” writers Rolfe Winkler and Andy Pasztor reported for The Journal.

The financial hit was so hard because of launch delays. SpaceX did an internal investigationand made changes to its rocket fleet and operations. It wouldn’t launch again until December 2015 — when it landed its first Falcon 9 booster on a launch pad — missing out on six of 12 planned launches.

A Falcon 9 launch costs third-parties about $62 million, which means SpaceX missed on its projected launch revenue by roughly $370 million.

What Did Elon Musk Promise?

Musk is a crony-capitalist of the worst ilk. He plays both side of the aisle and wraps it all up in fanciful oratory about colonizing Mars. American’s literally eat it up. Musk is so popular you would think he was the real Tony Stark. His latest dazzling promise was to send colonists to Mars by 2024 (for $200K a one-way ticket). No guarantees you will make it alive, and no, Musk won’t be joining you on the trip. Have fun being the first Martians.

The lofty interstellar goal of living on Mars is inspired by Star Wars and Star Trek dreams and comes with an out of this world price tag…about $10 billion. Rockets are expensive and Musk has plans to blow up a few more of them as he pretends to be colonizes the red planet. The last rocket that blew, the Falcon 9, cost several hundred million in lost cargo alone. Musk actually blames that on real Martian sabotage, but that’s another story.

ELON MUSK HAS DELIVERY ISSUES

But, while his grand gestures inspire awe and curiosity, they often fall short in the execution. Since 2011, Tesla has failed to meet Musk’s product-launch, production, and financial-performance promises more than twenty times, according to an analysis by the Wall Street Journal. Even a private showing, in early January, of Tesla’s new Gigafactory, in Storey County, Nevada—which Musk claims is on schedule to mass-produce lithium-ion batteries at rock-bottom costs by 2018—didn’t instill confidence in Musk’s ability to achieve his stated goals. As the Pacific Crest Securities research analyst Brad Erickson said in a note, the tour left “much to the imagination.”

And in September an explosion destroyed an unmanned SpaceX rocket on the launch pad during a fuelling exercise—an incident that called into question the viability of Musk’s radical notion to refuel craft en route, with astronauts on board. A little more than a year earlier, a NASA-funded SpaceX rocket carrying cargo destined for the International Space Station exploded two minutes after lift-off, destroying the payload. A NASA report on that incident raised questions about quality standards at Musk’s company.

SpaceX is super-cooling its rocket fuel— why that could be a problem

For nearly a year, SpaceX has been trying out something new: super-cooling the liquid oxygen (LOX) which is a key ingredient in rocket fuel. It’s called deep-cryo LOX, and the idea has been around since NASA began designing rockets over 60 years ago. But no one has had the guts to actually fly rockets regularly with deep-cryo LOX.

We spoke with associate professor of aerospace engineering at Georgia Tech, Mitchell Walker, to understand why SpaceX chills its LOX cooler than anyone else and whether or not this is a good idea.

Elon Musk’s Grand Ambition Is Boring

Master Plans, electric vehicles, artificial intelligence, solar roofs, hyperloops, and space rockets that land on ships…is there anything Elon Musk won’t attempt? Apparently not: it’s time to add tunnel boring to the list.

No, I’m not joking. Saturday morning Musk sent out a series of tweets describing his intent to create a tunnel boring company because “Traffic is driving me nuts.” He then added the following to his Twitter bio: “Tunnels (yes, tunnels).”

There are only two explanations: either A) Musk is joking, or B) Musk is serious. Both scenarios should unsettle Tesla (NASDAQ:TSLA) investors and Musk supporters.

Yes, Elon Musk Is Actually Really Boring

Musk is a serious person, but he can also be something of a loose cannon, making outlandish statements designed to troll the press or simply amuse himself. In a 2015 interview with Stephen Colbert he semi-seriously endorsed dropping nuclear weapons on Mars; last year he implied on Twitter that he’s developing an Iron Man-style flying suit for the Pentagon. Most reporters assumed that the tunnel thing was another one of his jokes.

Musk wouldn’t seem to be in a particularly good ideological position to benefit from Trump’s infrastructure largesse. He’s a climate change hawk who was so closely identified with the Obama administration that Mitt Romney attacked Tesla during the 2012 debates. (Tesla had received a government-guaranteed loan in 2010.) In the next presidential election, Musk supported Hillary Clinton for president, describing Trump, in an interview with CNBC, as a man who “doesn’t seem to have the sort of character that reflects well on the United States.”

Elon Musk’s Grand Ambition Is Boring

Master Plans, electric vehicles, artificial intelligence, solar roofs, hyperloops, and space rockets that land on ships…is there anything Elon Musk won’t attempt? Apparently not: it’s time to add tunnel boring to the list.

No, I’m not joking. Saturday morning Musk sent out a series of tweets describing his intent to create a tunnel boring company because “Traffic is driving me nuts.” He then added the following to his Twitter bio: “Tunnels (yes, tunnels).”

There are only two explanations: either A) Musk is joking, or B) Musk is serious. Both scenarios should unsettle Tesla (NASDAQ:TSLA) investors and Musk supporters.

Business ‘Savant’ Andrew Ross Sorkin Gets Elon Musk Very, Very Wrong

Actually, Elon Musk isn’t the Tony Stark of anything. And the only person behind Tesla and Solar City is a government bureaucrat – writing Musk yet another government check.

So far, Musk has received FIVE BILLION DOLLARS in government money – mostly for his “green energy” business fallacies. He is arguably the world’s largest welfare recipient.

And Musk’s ridiculous solar panel and electric car companies only serve as just two more totally unnecessary reminders that “green energy” is actually neither green nor energy.

Solar panels cost a ton of (government) money – and produce almost no energy for that money. You’ll never get back the up-front coin in lifetime energy savings. And the panels, once spent, have to be disposed of as if they are nuclear waste.

Electric cars also cost a ton of (government) money – and also cost way more up front than you’ll ever make up in energy savings over the life of the car. Unless you drive the car roughly two thousand years. And the energy it burns – is electricity. Which is produced mostly by…coal – an energy source from which the Green Machine is supposedly trying to escape.

Cut off Elon Musk’s Government Subsidy Gravy Train

Wednesday, Leonardo DiCaprio made a visit to Trump Tower. The reason? Selling the incoming administration on the creation of “millions of green jobs.” He wants the government to put its thumb on the scale to favor his pet industries. This nonsense must stop, and President Trump’s first one hundred day agenda would benefit from a plan for ending the out-of-control crony capitalism that has made this kind of activity commonplace.

DiCaprio is easy to criticize: a movie star who addresses the UN. He hectors the government to spend money on things that voters do not prioritize as highly as he does…because, you know, he knows best. But this does more than just infuriate voters. It is regulatory capture but on a grand, political scale. It warps capital markets, warps entire sectors of our economy and diverts entrepreneurs from market-driven pursuits.

It is not a theoretical point. Take the case of Elon Musk, who has become one of the more successful entrepreneurs chasing government dollars. In a sense, Musk is a tragic story of how one of the world’s most talented entrepreneurs has become sidetracked by crony capitalism.

We are all aware of President Obama’s obsession with electric vehicles (EVs), for example. In 2011, he pledged that the United States would have one million new generation electric cars on the road by 2015 and pledged billions to do it. He and a bipartisan consensus in Congress wasted gobs of money and warped markets to miss that absurd goal by a yawning margin. Likewise, he threw billions at solar energy with direct and indirect subsidies. Solar power is still not cost competitive.

From that, Musk made billions.

NYT reporter swoons over Elon Musk

Moreover, Mr. Musk caused a net loss of manufacturing jobs. Suppose the $4.9 billion he wrested from the government had instead been distributed to the private business community through lower taxes. The annual average cost of a manufacturing job in the United States, including pay and benefits, approximates $81,300. That means private businesses would have created approximately 60,000 manufacturing jobs if they had received the same financial support government showered on Mr. Musk. His three lavishly subsidized businesses have thus caused a net loss of 25,000 manufacturing jobs. Sorkin’s effusive praise of Musk as “a prime example of everything we want our business leaders to be” is nonsense on stilts.

Tesla: Where’s The Value?

The cherry on the cake is definitely this convoluted attempt by Musk to consolidate his “dreams” with the SolarCity merger. Neither company is financially sound. SolarCity has a hard time making money. Tesla ALMOST never makes money. So where’s the value? The notion that the two will create a solar house that charges your car for almost nothing is grand, but the timelines seem absurd. We can talk all we want about the merit of solar shingles and zero emissions. It very much is the way of the future. That doesn’t mean that Musk and his cohort are going to be the ones to succeed. As shareholders, you need to see a return on your investment. It has been years. Both companies have run up revenues. Both companies have failed to consolidate those gains. This story has Twitter (NYSE:TWTR) written all over it. In many ways both of these firms have been coddled into growth. Between subsidies and “enthusiastic” share pricing (which has allowed for large capital raising through stock sales), Tesla and SolarCity were given the fuel to get the show rolling. Unfortunately this same “incentive” has driven the two companies into complacency. Musk seems convinced that everyone will support his show to the end no matter how long it takes. The longer it takes to deliver some real results, the less likely this will be the case.

Elon Musk To Attend Trump Meeting Orchestrated By Musk’s Business Partner

Billionaire Elon Musk is attending President-elect Donald Trump’s tech industry meeting, which is being orchestrated by the tech-entrepreneur’s business partner, The Wall Street Journal reported.

Musk is the CEO of Tesla Motors and SolarCity, and is a close associate of Peter Thiel, the tech investor who backed Trump during his presidential campaign. Apple CEO Tim Cook and Facebook COO Sheryl Sandberg will also appear at the Wednesday meeting.

They were both founders of PayPal — and Thiel’s venture-capital firm Founders Fund also contributes millions of dollars to SpaceX.

SpaceX has been awarded contracts valued at more than $6.5 billion over the past eight years, mostly to delivering cargo to NASA’s primary space station. It’s also working on securing contracts from the Air Force valued at more than $100 million.

TSLA Stock: Analyst ‘Increasingly Concerned’ at Tesla’s Ability to Hit Profit Objectives

Despite the broader market closing at all-time highs, shares of electric car maker Tesla Motors(NASDAQ:TSLA) slipped 11 cents on Friday to close at $192.18. TSLA hit an intraday low of $190.81 following a research note from JP Morgan (NYSE:JPM) analyst Ryan Brinkman writing that after meeting with General Motors’ (NYSE:GM) CFO Chuck Stevens and test driving GM’s new Chevrolet Bolt, he expressed concern about Elon Musk’s company being able to achieve its profit objectives.

Commenting on the new Bolt, the analyst said the electric vehicle (EV) represents “solid competition” for Tesla’s upcoming compact luxury sedan Model 3 and that GM is the first automaker to globally market a “modestly” priced battery electric vehicle with a range in excess of 238 miles. Additionally, and to illustrate the importance of Bolt, Brinkman points out that GM plans to extend its EV beyond sales to consumers and into ride-sharing apps, including of the autonomous variety.

Brinkman, who reiterates an ‘Overweight’ and ‘Underweight’ rating on GM ($37.66) and Tesla stock, respectively, also notes that Tesla will find it increasingly difficult to profitably compete in an increasingly competitive market for electric vehicles.

It should be noted that this is not the first time Brinkman has expressed skepticism about Tesla’s ability to hit its objectives. Back in May JPM’s analyst said he was doubtful of Tesla’s production plans for its upcoming Model 3 mass-market to build a total of 500,000 all-electric vehicles in 2018, two years ahead of schedule.

“We previously held some hope that, with improved execution, Tesla could prove relative skeptics such as ourselves wrong, by in fact ramping to 500,000 units by 2020. We think they stood an outside chance of doing this. But these new targets we think standstill less chance of being accomplished within the given more aggressive timeframe,” Brinkman wrote at the time in a note to investors.

Elon Musk is not the answer for Democrats

Taxpayers also heavily bankroll Musk’s businesses. Last year, the Los Angeles Times reported that Musk’s corporate empire had received a total of $4.9 billion in government subsidies.

For example, the federal government gives each Tesla buyer a $7,500 tax credit. Many states give additional credits as well.

So, yes, Musk has made billions of dollars because taxpayers are subsidizing the purchase of $85,000 dollar sports cars and costly solar panels. I doubt that will sit well with working-class voters.

The only reason Tesla was profitable last quarter stems from the sale of $139 million dollars worth of “clean” tax credits to companies that make money from the sale of traditional, gas-burning cars and trucks.

Undoubtedly, Donald Trump is also a product of coastal elitism. However, Trump was able to overcome this hurdle with working-class voters by channeling their frustrations with elites.

Democrats hoping that Musk will be their billion